- IT leaders spend an inordinate amount of time and resources evaluating and procuring technology solutions that have become, or are rapidly becoming, commodities.

- The time wasted comparing features and functionality in commoditized markets can be measured in person-years in many organizations.

- Many IT leaders and procurement processes haven’t yet adapted to hyperchange (the law of accelerating returns) and rapid commoditization when evaluating technology markets.

Our Advice

Critical Insight

- Quickly identify where a technology market is in the race to commoditization.

- Change your procurement process – from product identification and evaluation to selection and purchasing.

- It will be necessary to work closely with procurement and finance to adapt processes to a changing technology market.

Impact and Result

- Leverage proven methodologies to reduce the selection and purchasing lifecycle from months or years to days or weeks.

- Using a standard market evaluation process, IT leaders can save time and resources by changing the way they evaluate products in markets that are rapidly becoming commoditized.

- Effectively communicate to the organization how hyperchange impacts technology markets.

Stop Wasting Time Evaluating Commoditized Products and Services

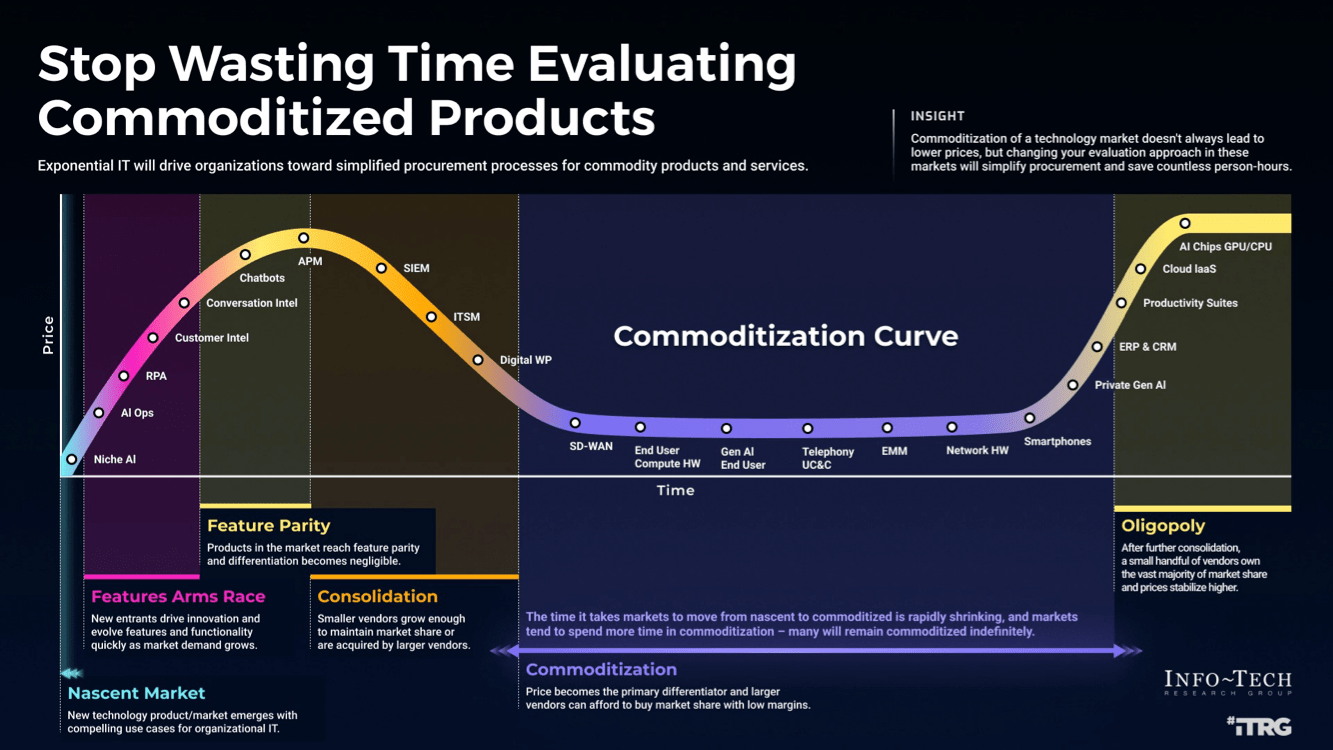

Exponential IT will drive all organizations toward simplified procurement processes for commodity products and services.

Analyst perspective

Technology markets are moving to commoditization faster than ever before, and that matters to IT leaders.

There’s a new word in the IT dictionary – hyperchange. It’s not a new concept, though – Moore’s Law led to the law of accelerating returns, which very naturally led to what is being called hyperchange. It means that the lifecycle time from innovation to commodity in most mainstream technology markets is rapidly shrinking. There have been many examples over the past 20 years including cloud computing, smartphones, and countless applications. Innovations are even being commoditized from the outset, particularly at the consumer level (e.g. ChatGPT).

What does this mean to IT leaders and vendors?

It means that innovative products in markets that not long ago took years to reach commodity status are now being commoditized in months.

Mark Tauschek

VP, Research Fellowships & Distinguished Analyst Info-Tech Research Group

Executive summary

Your ChallengeIT leaders spend an inordinate amount of time and resources evaluating and procuring technology solutions that have become, or are rapidly becoming, commodities. The time wasted comparing features and functionality in commoditized markets can be measured in person-years in many organizations.

Many IT leaders and procurement processes haven’t yet adapted to hyperchange (the law of accelerating returns) and rapid commoditization when evaluating technology markets. |

Common ObstaclesIt is possible to categorize technology markets based on product lifecycle and market behavior, but most organizations have dated procurement and vendor/product selection processes. Most procurement processes tend to view every product in every market as differentiated, making it a challenge to evaluate broader markets and technology landscapes to identify markets moving to commoditization.

|

Info-Tech's ApproachUsing a standard market evaluation process, IT leaders can save time and resources by changing the way they evaluate products in markets that are rapidly becoming commoditized.

Rethink the way you make purchasing decisions and evaluate solutions in markets moving to commodity. |

Info-Tech Insight

Commoditization of a technology market does not necessarily mean the products will be less expensive, but changing the way you evaluate products in commoditized markets will greatly simplify the procurement process and save the organization countless person-hours wasted evaluating commodity products.

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit

"Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful"

Guided Implementation

"Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track."

Workshop

"We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place."

Executive & Technical Counseling

"Our team and processes are maturing, however, to expedite the journey we'll need a seasoned practitioner to coach and validate approaches, deliverables, and opportunities."

Consulting

"Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project."

Diagnostics and consistent frameworks are used throughout all five options.

Commoditization of technology markets is not new

But it is happening much faster.

- This concept has been understood for decades, but like the proverbial frog in the boiling water, people tend to maintain the status quo and keep doing things the way they always have.

- What has changed dramatically is the speed with which most technology markets move through the tech commoditization curve stages.

- This exponential acceleration of technology market commoditization has outpaced any evolutionary procurement and vendor management processes.

- In the age of exponential IT, where autonomization will allow organizations to purchase or license capabilities, differentiation will be negligible in many IT and organizational functions.

“As the commoditization of IT continues, the penalties for wasteful spending will only grow larger. It is getting much harder to achieve a competitive advantage through an IT investment, but it is getting much easier to put your business at a cost disadvantage.”

– Nicholas G. Carr, HBR, 2003

Watch for the exceptions

Look for accelerated progression.

- As the exponential advancement of technology accelerates through the knee of the curve, markets will move through the phases at an increasingly accelerated pace.

- Most technology markets follow a similar cycle, but some markets skip phases, get stuck in a phase, or the odd anomaly doesn’t fit.

- Recently, some markets are moving from nascent to commodity or oligopoly almost overnight. Consumer or end-user GenAI is a good example of a technology that was commoditized almost immediately. In November 2022, OpenAI publicly released ChatGPT 3.5 for free, and it had the fastest adoption of a technology in history, getting to 100 million users in just two months. In March 2023, OpenAI released ChatGPT 4.0 with a $20 monthly subscription, and Anthropic’s Claude and Google’s Bard (now Gemini) were released free of charge, confirming the move to commoditization.

What to watch for:

- Markets with a high barrier to entry tend to move directly to oligopoly. Examples include cloud IaaS and private LLM GenAI (i.e. OpenAI in Azure).

- Strategic, high-cost applications like ERP or CRM are exceptions. While they tend toward oligopoly and have near feature parity, an accelerated selection and procurement process is not advisable. When selecting an enterprise application in this category, the vendor becomes strategic, and you will be locked into this vendor for the foreseeable future. The cost of switching vendors is prohibitive, so be sure to make the right choice the first time.

Stage 1 – Nascent Market

A new technology product/market emerges with compelling use cases for organizational IT.

- These new products and vendors have the potential for broad market appeal but have not been fully developed or widely used.

- Organizations that purchase at this stage are typically early adopters of technology, or the new product may have a specific use case that is very compelling and valuable to certain industries.

- Caveat emptor – let the buyer beware at this stage, as products and vendors may fail to thrive in the market or lag behind in a features arms race, threatening their long-term viability.

Stage 2 – Features Arms Race

New entrants drive innovation and evolve features and functionality quickly as market demand grows.

- New entrants quickly enter the market and battle for differentiation and market share.

- The speed of feature releases can be dizzying and difficult to manage.

- Rapid product updates and “feature dumping” in marketing material abound.

- Products are differentiated only briefly as competing vendors quickly match features.

Stage 3 – Feature Parity

Products in the market reach feature parity and differentiation becomes negligible.

- Products in the market can no longer differentiate by adding new features because the possible features and functionality have been included in competing products.

- The primary way to differentiate going forward will be price, although variables such as vendor relationship, service, and ecosystem will be considerations.

- Purchasing at this stage tends to be more strategic, and a vendor management initiative is important to identify existing strategic vendors where purchasing power can reduce the cost.

Stage 4 – Consolidation

Smaller vendors must grow enough to maintain market share, or they will be acquired by larger vendors.

- Some smaller vendors can’t compete as larger vendors essentially buy market share by acquiring competitors and lowering prices.

- When the smaller vendors can’t maintain market share or remain viable with shrinking margins, they drop out of the market if they are not acquired.

- Some smaller vendors may hang on if the serve a particular niche requirement, but the rarely thrive amid consolidation.

Stage 5 – Commoditized

Price becomes the primary differentiator, and larger vendors can afford to buy market share with low margins.

- Commoditized markets have far fewer vendors after consolidation, and they are usually larger vendors in their respective markets.

- Larger vendors are also able to leverage their installed base and their strategic relationship with customers.

- Vendor lock-in is one of the byproducts of this stage as the cost of switching vendors is typically prohibitive, and it will amplify in the oligopoly stage.

Stage 6 – Oligopoly

A small handful of vendors own the vast majority of market share after further consolidation, and higher prices stabilize.

- The remaining vendors are the ones who could afford to buy market share along the way.

- This stage can often look like a monopoly – think Office 365, now Microsoft 365.

- Vendor lock-in is nearly absolute – the cost of switching at this stage is almost always prohibitive.

The Microsoft Effect

Its entry into new markets can profoundly change the dynamic and accelerate commoditization and oligopoly.

Case studies:

- Hyper-V in 2008 changes the server virtualization market

- Azure in 2010 (rebrand in 2014) brings real competition to IaaS market

- Intune in 2011 (rebrand in 2014) changes the MDM market

- Teams in 2017 gets traction in 2020 during the pandemic

Internet Explorer

Hyper-V

Azure PaaS/IaaS

Intune

OneDrive

Defender

Teams

Copilot

Case study: Basic server virtualization

Microsoft: Hyper-V

vmware: ESXi

Microsoft Hyper-V drives commoditization.

Hyper-V entered the market in October 2008, a couple of years after VMware ESX had begun to dominate the server virtualization market.

Hyper-V was by all accounts mediocre and lacked the features, functionality, and maturity of ESX, but Microsoft started giving it away for free with Windows Server 2008.

This forced VMware to offer a free, limited-use version of ESX, and the race to the bottom for basic server virtualization had begun. Microsoft continued to iterate on Hyper-V, and it got to the point where it was good enough for 80% of the market, which was the goal.

Results

VMware evolved far beyond basic server virtualization and flourished with orchestration tools, digital workspace, workload automation, network virtualization, and many other advanced data center infrastructure management tools, and Microsoft did not even try to keep up, but basic server virtualization remains commoditized.

Case study: Public cloud PaaS/IaaS

Microsoft: Azure

Amazon web services

Azure introduces competition and ultimately an oligopoly.

Windows Azure was officially launched in February 2010 and later renamed to Microsoft Azure on March 25, 2014. It was platform and infrastructure as a service, and PaaS did get more traction in the market initially, but IaaS quickly caught up.

Amazon Web Services (AWS) was the only game in town since it launched in March 2006, but Microsoft had the scale, data centers, money, and patience to build out its own product. Microsoft Azure was not very competitive at first, but within 18 months it was very competitive.

Results

While AWS still leads in market share with 31%, Microsoft has continued to gain on them with 25% as of Q1 2024. Google is a distant third with 11%, so two thirds of the market share in the global Cloud IaaS market is with three vendors. That is the definition of oligopoly.

Source: Statista via Synergy Research Group, 2024

Case study: Mobile device management

Microsoft: Intune

Airwatch

MobileIron

Cirtix: XenMobile

MaaS360

SOTI: Mobicontrol

Intune accelerates MDM to commoditization.

Microsoft Intune was not competitive in features or functionality when it was introduced in 2014 (initially launched as Windows Intune in 2011), but it was bundled with Office 365 licensing, so free for many. Within 18 months it was getting to feature parity for basic mobile device management (MDM) due to the restrictive device management APIs for Apple and Android.

Since it was free for many, the MDM vendors that remained in the market after consolidation had to lower prices and, of course, profit margins. Even for VMware, Citrix, and IBM after they purchased AirWatch, Zenprise, and MaaS360, respectively, it was not profitable to try to buy market share against Microsoft’s bundling technique. And with that, the MDM market was never the same.

Results

With MDM completely commoditized, the remaining vendors evolved to enterprise mobility management (EMM) and unified endpoint management (UEM), and Intune did not really attempt to keep up in a meaningful way because they already had the market share they wanted in basic MDM and endpoint management.

Case study: Web conferencing and virtual meetings

Microsoft: Teams

Webex by Cisco

GoToMeeting by LogMe

Zoom

The pandemic accelerates Microsoft Teams.

Teams initially launched in March 2017 and got very little traction even though it was bundled with Office 365. Zoom had launched in January 2013, and few had heard of it before the pandemic. Cisco’s Webex or Citrix/LogMeIn’s GoToMeeting were the de facto standards in most organizations.

Teams lacked features and functionality at the beginning of the pandemic, and consumers and many organizations flocked to Zoom for its simplicity and functionality. But most organizations had Teams free with Office 365, so they started using it, and it improved, and within 18 months it was good enough for most. Where are Webex and Zoom now? Microsoft commoditized the market inside of two years.

Results

Teams is the dominant video/web conferencing and virtual meeting software in the enterprise market. Zoom and Webex are still around, but Zoom is struggling. Its stock price peaked at $559 per share in October 2020 and is now back below prepandemic levels at ~$69 per share.

Modernize procurement processes

The luxury of time is quickly evaporating.

- Many IT leaders and procurement processes haven’t yet adapted to hyperchange and rapid commoditization when evaluating technology markets.

- It is possible to categorize technology markets based on product lifecycle and market behavior, but most organizations have dated procurement and vendor and product selection processes.

- Many procurement processes tend to view every product in every market as differentiated, making it a challenge to evaluate broader markets and technology landscapes to identify markets moving to commoditization. It makes selecting technology solutions a painful experience.

“As the commoditization of IT continues, the penalties for wasteful spending will only grow larger. It is getting much harder to achieve a competitive advantage through an IT investment, but it is getting much easier to put your business at a cost disadvantage.”

– Nicholas G. Carr, HBR, 2003

Selecting software is a painful experience

Few organizations have evolved how they select applications.

Selection takes forever

Traditional software selection drags on for years; sometimes in perpetuity.

”RFP” overload kills momentum

Time is wasted documenting an endless list of table-stakes features.

Vendors put on dog and pony shows

Glossy presentations and slick salespeople obscure real product capabilities.

Stakeholders aren’t satisfied

Stakeholders grumble that deployed solutions don’t meet critical needs.

Decisions aren’t data driven

“Gut feel” and intuition guide selection, leading to poor outcomes.

Negotiations are a weak link

Money is left on the table by inexperienced negotiators.

The result?

Wasted time. Wasted effort.

Applications that continually disappoint.

Looking at Risk in a New Light: The Six Pillars of Vendor Risk Management

Looking at Risk in a New Light: The Six Pillars of Vendor Risk Management

Manage Exponential Value Relationships

Manage Exponential Value Relationships

Jump Start Your Vendor Management Initiative

Jump Start Your Vendor Management Initiative

Capture and Market the ROI of Your VMO

Capture and Market the ROI of Your VMO

Cut Cost Through Effective IT Category Planning

Cut Cost Through Effective IT Category Planning

Design and Build an Effective Contract Lifecycle Management Process

Design and Build an Effective Contract Lifecycle Management Process

Maximize Value From Your Value-Added Reseller (VAR)

Maximize Value From Your Value-Added Reseller (VAR)

Drive Successful Sourcing Outcomes With a Robust RFP Process

Drive Successful Sourcing Outcomes With a Robust RFP Process

Reduce Risk With Rock-Solid Service-Level Agreements

Reduce Risk With Rock-Solid Service-Level Agreements

Slash Spending by Optimizing Your Software Maintenance and Support

Slash Spending by Optimizing Your Software Maintenance and Support

Identify and Manage Financial Risk Impacts on Your Organization

Identify and Manage Financial Risk Impacts on Your Organization

Identify and Manage Strategic Risk Impacts on Your Organization

Identify and Manage Strategic Risk Impacts on Your Organization

Identify and Manage Reputational Risk Impacts on Your Organization

Identify and Manage Reputational Risk Impacts on Your Organization

Identify and Manage Security Risk Impacts on Your Organization

Identify and Manage Security Risk Impacts on Your Organization

Evaluate Your Vendor Account Team to Optimize Vendor Relations

Evaluate Your Vendor Account Team to Optimize Vendor Relations

Elevate Your Vendor Management Initiative

Elevate Your Vendor Management Initiative

Prepare for Negotiations More Effectively

Prepare for Negotiations More Effectively

Implement Your Negotiation Strategy More Effectively

Implement Your Negotiation Strategy More Effectively

Evaluate and Learn From Your Negotiation Sessions More Effectively

Evaluate and Learn From Your Negotiation Sessions More Effectively

Proactively Identify and Mitigate Vendor Risk

Proactively Identify and Mitigate Vendor Risk

Master the Public Cloud IaaS Acquisition Models

Master the Public Cloud IaaS Acquisition Models

Essentials of Vendor Management for Small Business

Essentials of Vendor Management for Small Business

Identify and Manage Regulatory and Compliance Risk Impacts on Your Organization

Identify and Manage Regulatory and Compliance Risk Impacts on Your Organization

Identify and Manage Operational Risk Impacts on Your Organization

Identify and Manage Operational Risk Impacts on Your Organization

Don’t Allow Software Licensing to Derail Your M&A

Don’t Allow Software Licensing to Derail Your M&A

Identify and Reduce Agile Contract Risk

Identify and Reduce Agile Contract Risk

Improve Your Statements of Work to Hold Your Vendors Accountable

Improve Your Statements of Work to Hold Your Vendors Accountable

Understand Common IT Contract Provisions to Negotiate More Effectively

Understand Common IT Contract Provisions to Negotiate More Effectively

Master Contract Review and Negotiation for Software Agreements

Master Contract Review and Negotiation for Software Agreements

Master the MSA for Your Managed Services Providers

Master the MSA for Your Managed Services Providers

Negotiate SaaS Agreements That Are Built to Last

Negotiate SaaS Agreements That Are Built to Last

Establish a Vendor Management Roadmap to Succeed With Autonomous Technologies

Establish a Vendor Management Roadmap to Succeed With Autonomous Technologies

Price Benchmarking & Negotiation

Price Benchmarking & Negotiation

Stop Wasting Time Evaluating Commoditized Products and Services

Stop Wasting Time Evaluating Commoditized Products and Services

Ensure Business Alignment in Managed Service Agreements

Ensure Business Alignment in Managed Service Agreements

Comparing Software Practices in Maturing IT

Comparing Software Practices in Maturing IT

Run IT By the Numbers

Run IT By the Numbers

Transform IT, Transform Everything

Transform IT, Transform Everything

The Race to Develop Talent

The Race to Develop Talent

Building Info-Tech’s Chatbot

Building Info-Tech’s Chatbot

Assessing the AI Ecosystem

Assessing the AI Ecosystem

Sync or Sink: Aligning IT and HR for the Future of Work

Sync or Sink: Aligning IT and HR for the Future of Work

Building the Road to Governing Digital Intelligence

Building the Road to Governing Digital Intelligence

Bring AI Out of the Shadows

Bring AI Out of the Shadows

The AI Vendor Landscape in IT

The AI Vendor Landscape in IT

IT Spend and Staffing Benchmarking

IT Spend and Staffing Benchmarking

An Operational Framework for Rolling Out AI

An Operational Framework for Rolling Out AI

Optimize IT Vendor Contracts in Times of Uncertainty

Optimize IT Vendor Contracts in Times of Uncertainty