MSFT Q2 FY20 Earnings – Cloud Strength Propels Microsoft to New Heights

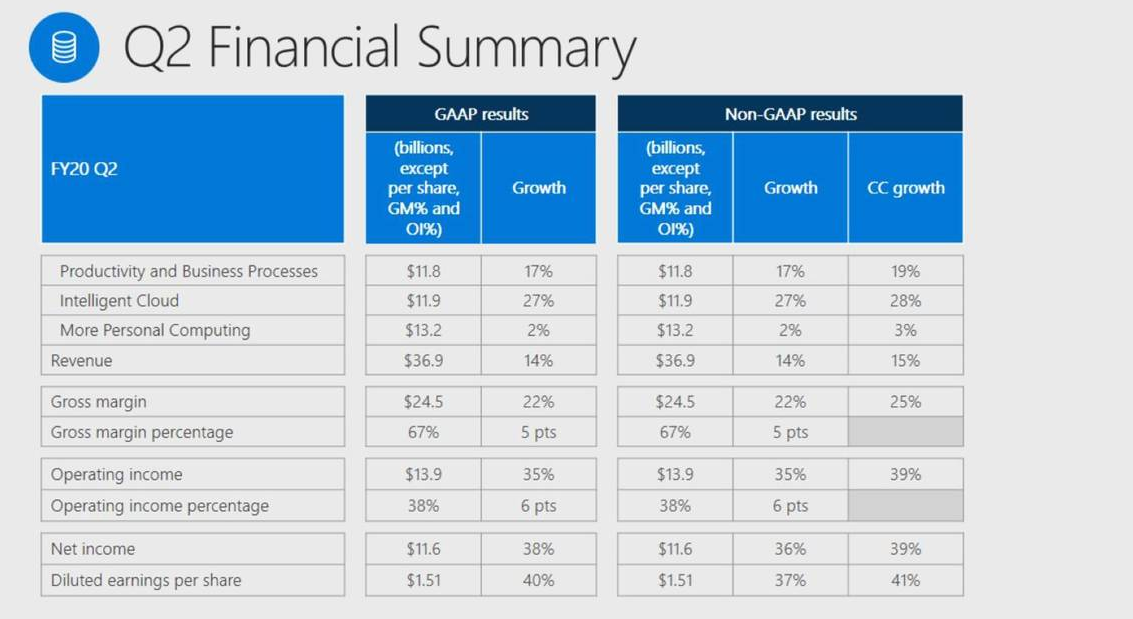

Microsoft reported earnings for their Q2 FY20, and the results continue to amaze, with revenue of $36.9 billion (YoY growth of 14%). All three of Microsoft’s operating segments saw material year-over-year (YoY) growth.

Microsoft continues its winning streak of seemingly never-ending earnings beats, but this quarter was exceptional.

Source: Microsoft Earnings

Breaking out the earnings numbers and overall performance by operating segment provides a lens into where the growth is coming from for Microsoft. It should not come as a surprise that “all things cloud” are at the center of this universe.

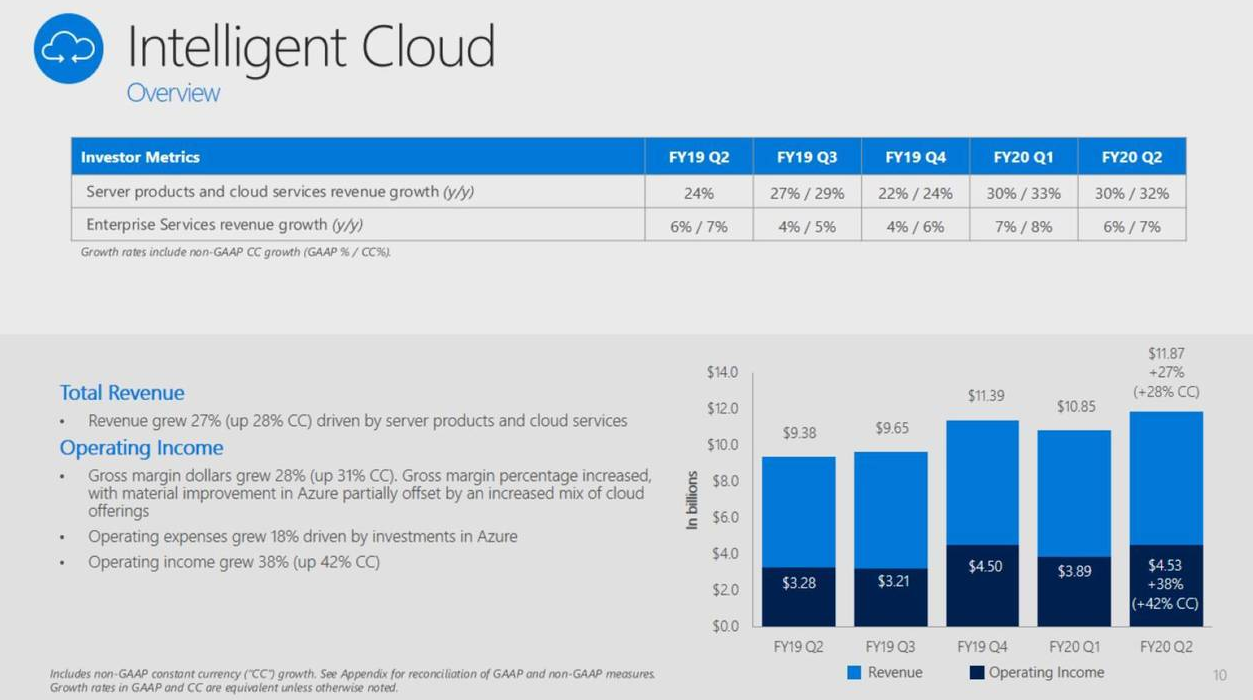

Microsoft Intelligent Cloud

Intelligent Cloud revenue clocked in at $11.9 billion, an increase of 27% from Q2 FY19. This segment always focuses on Azure, which grew at a 62% YoY pace and up 3% from Q1’s 59%. This growth uptick is encouraging as the general trend has been for a declining Azure growth rate as the platform hits scale, and the growth then comes off a broader base.

The primary question people want to know is if Azure is gaining market share from AWS. This is difficult to decipher from the earnings releases and data alone. However, there should be a new analysis at the macro-level later this year. A 1-3% market share gain by Microsoft is not out of the question, and according to several investment bank CIO surveys, Microsoft is winning the hearts and minds of the CIOs over AWS.

The Commercial Server segment also saw growth of 30%. At the same time, Enterprise Services grew 6%, bolstered by the revamped Premier Support program that is now called Unified Support, and it also comes with a handy and hefty price increase for Microsoft’s captive enterprise customer base. This is evidenced by a 28% increase in gross margin dollars on the back of a revenue increase of only 9%!

Source: Microsoft Earnings

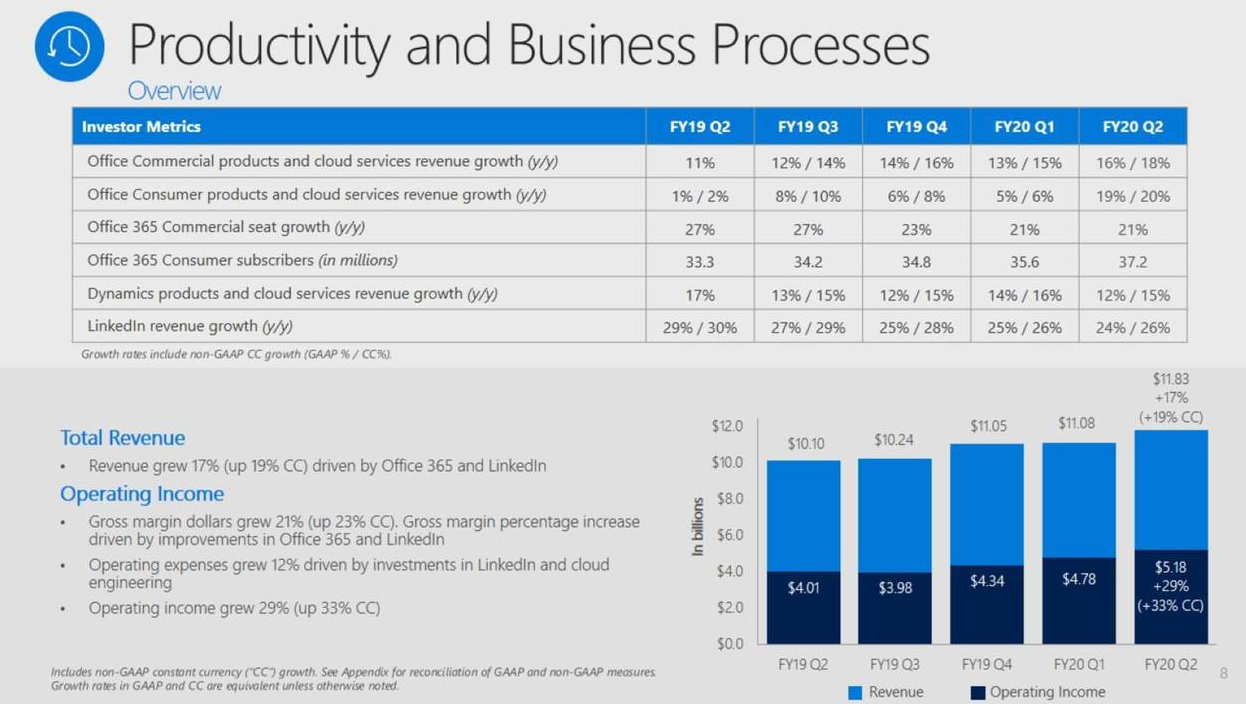

Microsoft Productivity and Business Process

Productivity and Business Process revenue clocked in at $11.8 billion, an increase of 17% from Q2 FY19. And here we first look at the Office productivity suite, where Office 365 led the way with a stunning growth rate of 27%. Office 365 subscribers now number 37.2 million.

Not to be left behind, LinkedIn posted a 24% growth rate as well, with LinkedIn sessions growing by 25% with “record levels of engagement.”

Continuing to show strength with a product transition to the cloud, Dynamics 365 checks in with a 42% growth rate (12% growth for all Dynamics products), with Microsoft’s Power Platform and growing citizen-developer community setting the stage for the next round of business-productivity growth.

Microsoft is investing heavily in Dynamics 365 and Power Platform to compete directly with Salesforce in the CRM space. They are also seeing success in migrating legacy customers to the new cloud suite while adding net new customers as well.

Source: Microsoft Earnings

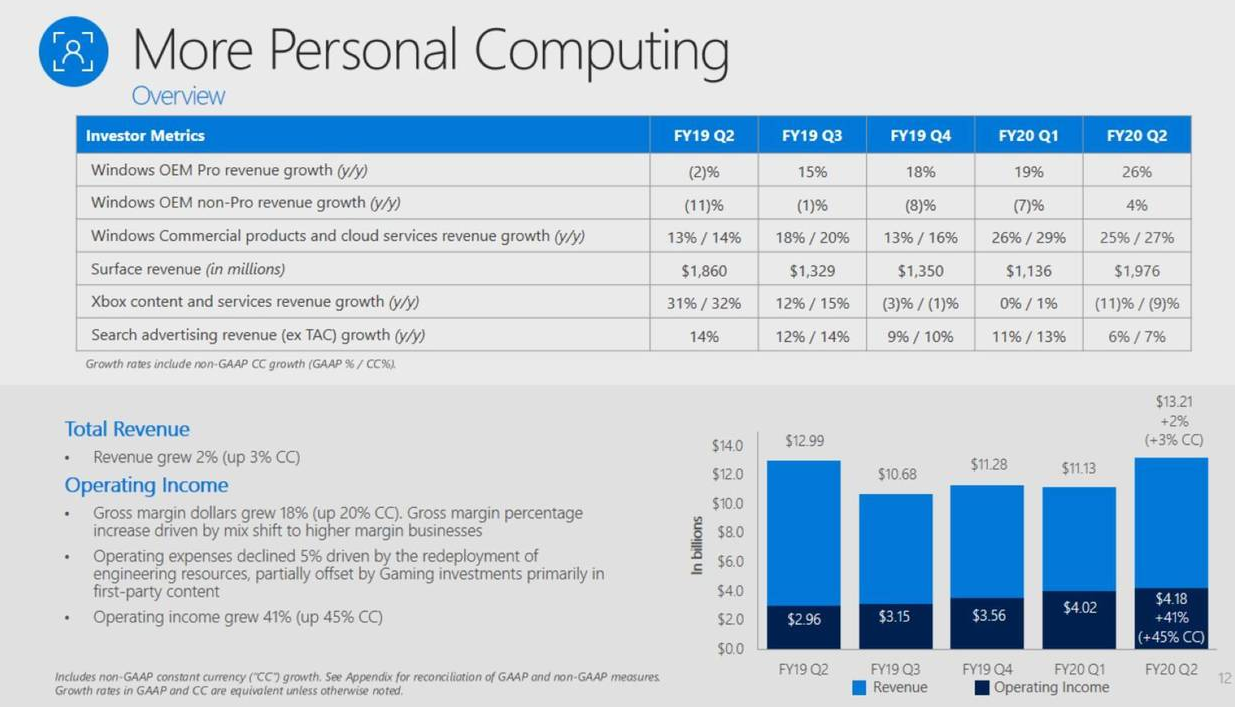

Microsoft Personal Computing

This category saw revenues of $13.2 billion with a much slower growth rate of 2%. Surface saw a 6% uptick in growth with new models such as the Pro X, Pro 7, and Laptop 3 coming online.

Windows did surprise to the upside with an 18% growth rate in OEM and 25% in the commercial space. Most of this growth is attributable to the Windows 7 retirement and requisite upgrades.

Source: Microsoft Earnings

Our Take

Continued strength in Azure growth rates, double-digit growth from Office 365 and LinkedIn, and tremendous Dynamics 365 growth demonstrate that Microsoft is hitting on all cylinders with no end in sight. IT leaders can reasonably expect Microsoft to continue to invest in their cloud-based offerings to drive innovation with the likes of Teams, Power Platform, and Dynamics 365. These investments, coupled with such a dominant market presence, also bode strongly for continued and regular price increases by our friends in Redmond.

Want to Know More?

Modernize Your Microsoft Licensing for the Cloud Era

Microsoft Dynamics 365: Understand the Transition to the Cloud

Microsoft Earnings Soar on the Heels of Inspire Partner Conference

Microsoft Is Reducing Software Assurance Benefits Again

Microsoft Self-Service Purchasing in Office 365

Microsoft Drops Azure Archive Storage Pricing

Microsoft and Zoom Announce Partnership for Enhanced Web Conferencing

Microsoft Teams Innovations to Benefit Healthcare Organizations

Oracle-Microsoft Cloud Partnership Provides Benefits for Both Vendors, but What About the Customers?