SAP-Qualtric Acquisition Seeks to Connect the Xs and Os

SAP’s Qualtrics acquisition, just before its IPO went live, was completed in January 2019 for an all-cash price of $8B; its second-largest acquisition ever behind the Concur deal in 2014. The staggering amount paid by SAP should leave current SAP clients curious to understand SAP’s strategy and its “big picture” vision for the future.

The fact that SAP purchased yet another high-flying "cloud king" such as Qualtrics is no surprise on its own. SAP has been making a habit of buying best of breed (BoB) cloud-native businesses in the prime of their growth years and adding them to the SAP eco-system, turbocharging revenues and profits along the way.

What stands out with the Qualtrics deal, however, are two things:

- The staggering price of $8B is roughly 10X the projected revenue of Qualtrics this year (est. ~$800M)

- The sheer passion and intensity expressed by SAP and its CEO, Bill McDermott.

Source: SAP [CC BY-SA 3.0]

We can table the price tag, as it is a visible indicator of a broader vision by SAP. Fortunately, SAP has not wasted time in telling its side of the story. But first a quick look at what Qualtrics is and does.

Who is Qualtrics?

The company was founded in 2002, yet the company's initial VC funding round arrived just a few short years ago in 2012. This was no ordinary round of VC-backed investment either. Two of the top VC funds, Sequoia Capital and Accel Partners, invested $70M in Qualtrics; this eventually led to further rounds of funding and a public IPO set to debut in 2018 under the ticker symbol "XM."

What does “XM” stand for you ask? Qualtrics has worked tirelessly to be known as The “Experience Management” company. For years after its founding in 2002, the founding Smith family (father Scott, brothers Ryan (CEO) and Jared, along with Stuart Orgill) pioneered the art and science of measuring all manner of "experiences."

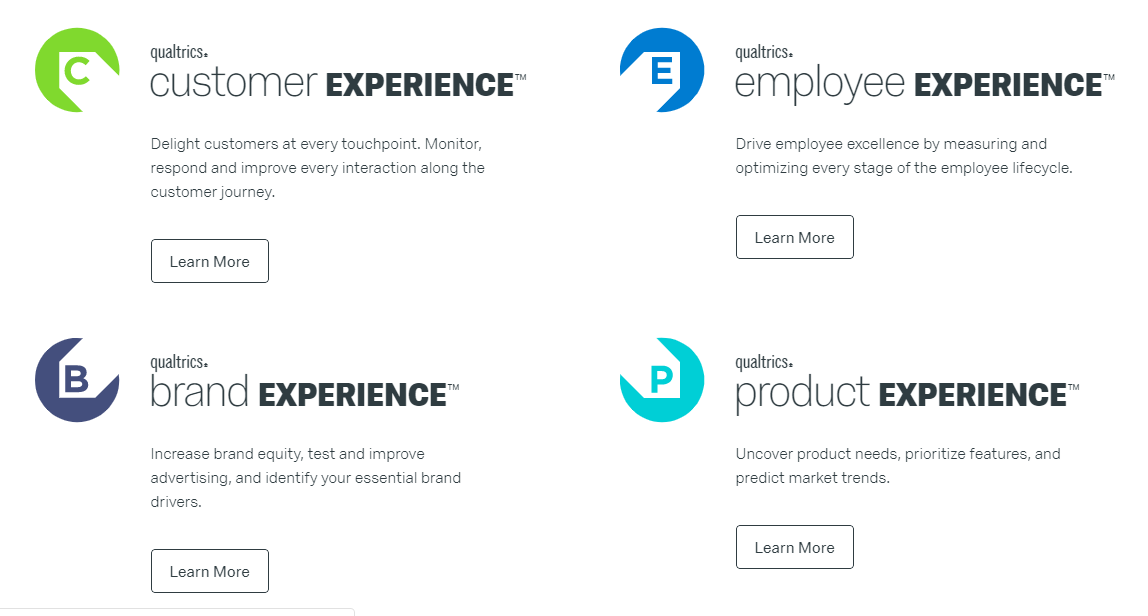

Source: Qualtrics, Nov. 19, 2018

Going back to Qualtrics’s roots, one finds a story of innovation paired with grit, determination, and a steadfast viewpoint that experiences matter and they matter greatly. Qualtrics cut its teeth in the brutal commercial world of academia, selling its survey software to facilitate academic research before growing and maturing into the company it is today. With over 9,000 customers and 65% of the Fortune 500 as customers, Qualtrics was quite well established before its acquisition.

Interestingly enough, starting in the realm of academia had an unintended positive side effect, as Qualtrics later realized that new college graduates were requesting its solution within their new enterprise employers! Similar to Adobe in this respect, once students are trained on a technology stack that effectively accomplishes a set of goals, they naturally want to extend that skill set into their professional lives.

Qualtrics is now much more than a survey company, as it has tools and underlying algorithms to enable companies to effectively collect and measure data across the employee, customer, brand, and product experience. Clients can then access actionable insights on this experience data and rapidly improve essential products or processes.

Qualtrics takes a “land and expand” approach to growing its core business, starting in one department to address a customer pain point, and then leveraging that success across the organization. Another sign that SAP sees something “bigger” in Qualtrics is the fact that the average deal size is only $45k, with ~576 customers paying over $100k. These are “mini-deals” compared to SAP’s monstrous transaction sizes.

SAP Xs and Os Strategy

SAP's CEO has declared that Qualtrics is already the "crown jewel" of the company (SAP). One cannot over-emphasize the importance or magnitude of this statement by SAP. With almost $40B/year in revenues, SAP is a juggernaut in the enterprise software space, so what gives? Either SAP is overplaying a weak hand or it genuinely believes Qualtrics is the key to enable its vision of connecting the supply chain/operations (back office) to the demand chain (front office) that has been so elusive for eons.

The SAP vision is to ultimately enable the transformational connection of back-office operational data (the "Os”) with the Qualtrics experience data (the “Xs") to create a real (XO) end-to-end solution. This makes logical sense as the legacy ERP days are mostly over and SAP has a massive on-premises installed base that needs migrating to S4/C4 HANA, which will take several more years.

However, the road to HANA is a rough one. Yes, SAP has purchased its way to a global scale in the subscription SaaS economy, and this has enabled the company to grow profitably during the process. In spite of this success, SAP still finds itself trailing Salesforce.com in CRM, battling it out in HCM against the likes of Workday and Oracle, and Microsoft is beefing up its own game in the Dynamics 365 space.

SAP-Qualtrics Benefits and Challenges

To be sure, the road ahead for SAP is going to be difficult and expensive as it seeks to build out the vision of linking its established, but aging, supply chain software with the contrasting dynamics of modern-day customer/product demand, sales, and marketing capabilities. McDermott has already laid the groundwork for this vision with SAP's C/4HANA customer experience suite to be linked back to ERP data, providing the ever-elusive 360-degree customer view.

- Benefit: Qualtrics does represent a quantum leap forward in customer-focused capabilities, which a successful integration holds great promise. Qualtrics also enables SAP to look beyond the B2B world and to entertain how it can interact at the B2C level, a much larger pie.

- Benefit: SAP has committed to Wall Street to triple its cloud business size by 2023, which is fast approaching. Qualtrics will bring a sizzling 45% growth rate atop an $800M a year business to bear on this goal immediately.

- Benefit: Qualtrics's leadership seems to have bought into the SAP story. CEO and founder Ryan Smith was quoted on CNBC as saying, "We had a chance to change the Experience Economy forever.”

- Challenge: As noted already, the bulk of SAP's installed base is on legacy ERP, HCM, and CRM systems predicated on outdated methods of task administration. Compared to the modern, cloud-native environments of Salesforce and Workday, SAP had to execute on its vision to change the narrative related to value delivery to remain relevant.

- Challenge: Qulatrics brings the proven solution to unveil an organization's critical issues with customer experience (CX) and employee experience (EX), and even makes the argument that a good employee experience leads to a good customer experience. The problem is that when issues are uncovered in the "experience economy," they are people problems – the toughest challenges to sort out! So SAP may find it can handily expose an organization's weaknesses, but fall short of supplying the solutions. The usual suspects (Deloitte, Accenture, PWC, EY, etc.) in the SAP eco-system are ill-equipped to deal with the "human factor."

Recommendations

SAP customers need to consider how the Qualtrics acquisition may affect them:

- Are you a Qualtrics customer? Find and review your Qualtrics agreement with an aim to extend the term and hold pricing stable for as long as possible. It is highly likely that SAP will be trading contract language and increasing pricing, eventually.

- SAP’s road to integrate Qualtrics into the complex and convoluted SAP eco-system will be painful and expensive. SAP will seek higher license and support fees from existing clients to subsidize this transformation. Understand where you are on the SAP value chain and your future roadmap containing SAP solutions.

- If considering an experience management solution, leverage Qualtrics as a vendor option to improve terms in your legacy SAP agreements.

Bottom Line

SAP is going to be driving harder bargains and raising prices. SAP has formalized and implemented a robust customer audit program. SAP customers need to assume an offensive, proactive posture in negotiations with SAP starting now.

Want to Know More?

- SAP S4/HANA and HANA Licensing Series – Part I: The Forced “Upgrade”

- SAP S4/HANA and HANA Licensing Series Part II: HANA DB Hype?

- Explore the Secrets of SAP Software Contracts to Optimize Spend and Reduce Compliance Risk

- Indirect Access of SAP Systems May Cost You Millions

- SAP Presents a Generational Opportunity to Re-Negotiate Your ERP Contracts

- SAP S/4HANA – Software Reviews