Every organization in every industry risks being sideswiped by today’s rapid technological advancement, geopolitical disruptions, and demographic shifts. Senior IT leaders can use our research to understand why key technology trends matter, then follow our practical steps to make sure their organization isn’t left behind.

The future is already here, unfolding in real time. Organizations can no longer afford to simply react – survival depends on anticipating what’s next. For IT leaders, the mandate is clear: proactively align emerging technologies with strategic capabilities to build a foundation for transformation – before the market demands it.

1. The next decade will not reward incrementalism.

Organizations stubbornly clinging to legacy models risk becoming case studies of what went wrong. Digital-first enterprises will grow two to four times faster than their peers by monetizing data, offering outcome-based services, and accessing new revenue streams. These winners will emerge as next-generation market-makers who rewire how value is created and captured.

2. Transformation isn’t just digital.

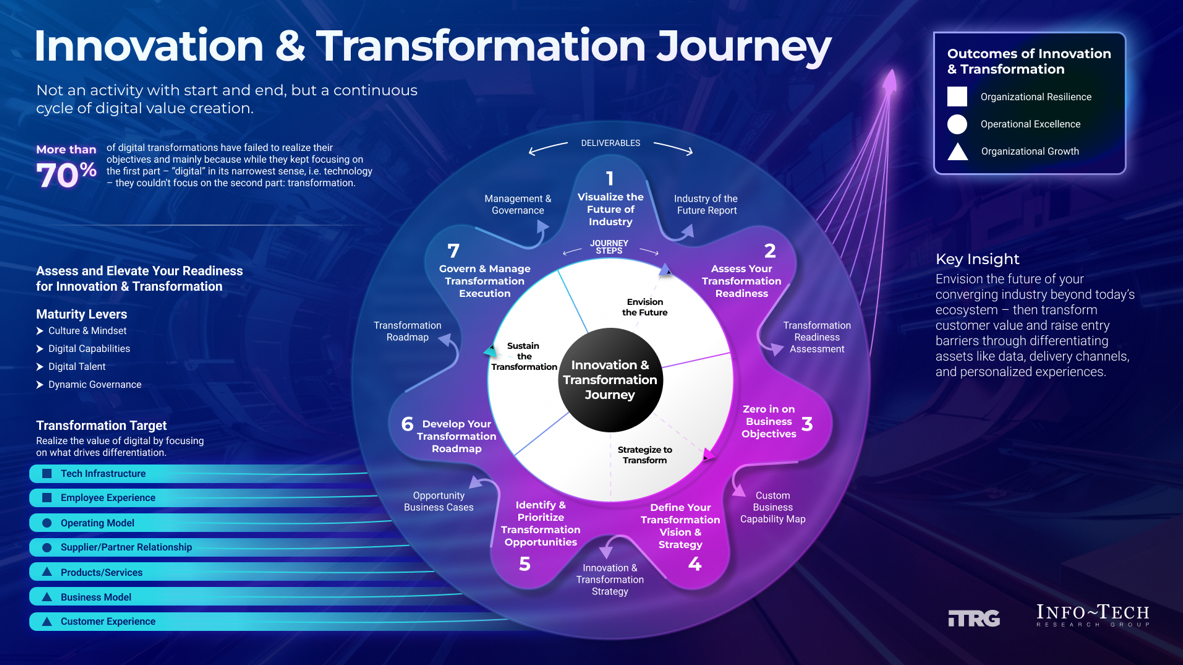

More than 70% of digital transformations have failed to achieve their main goals. Why? They focus too narrowly on the digital part, transforming technology but not the organization itself. Besides tech infrastructure, transformation also involves customer experience, employee experience, the business model, the operating model, supplier and partner relationships, and products and services.

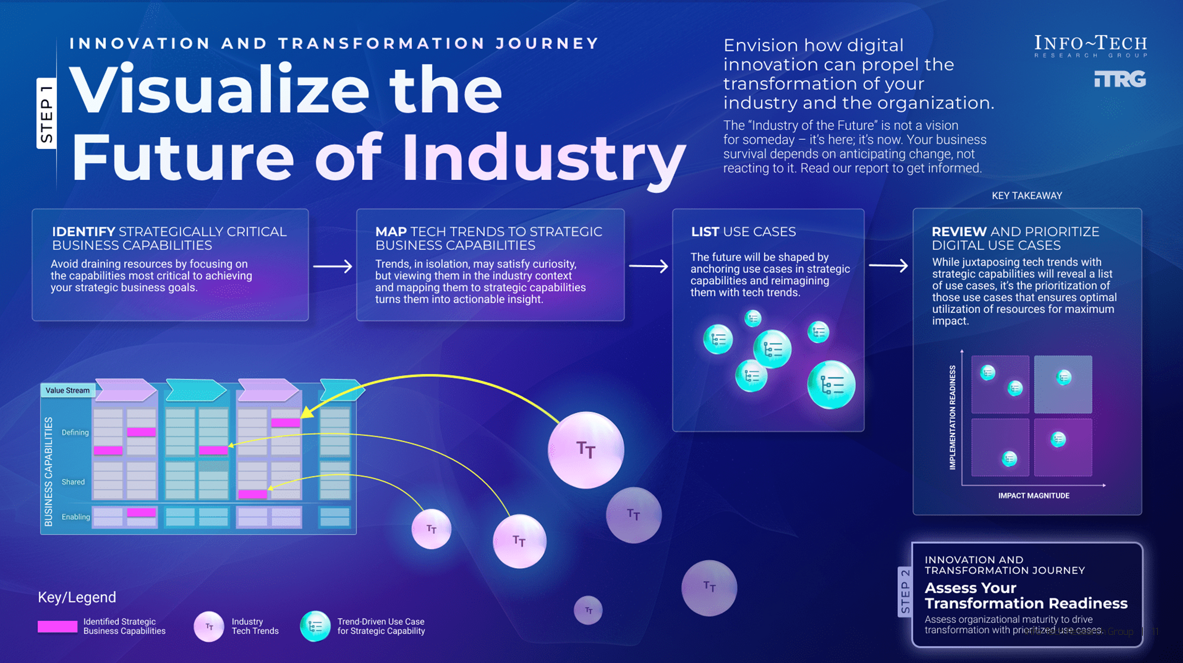

3. Technology trends are worthless without context.

Though it’s tempting to pounce on all the latest tech trends for fear of missing out, viewing them in isolation sends you down a misguided path and squanders your organization’s resources. You can’t turn tech trends into actionable insights until you put them into the context of what’s happening in your industry and your organization.

Use our intuitive report to shape the future of your industry, not just adapt to it.

Follow our practical three-phase approach to reinvigorate the discussion with your board and CEO on digital innovation and transformation and evangelize the role of technology in the future of your sector and your organization.

- Avoid draining resources – Casting a wide net to every trend will not capture the results you need. Focus on the capabilities most critical to achieving your strategic organizational goals instead.

- Map tech trends to strategic business capabilities – Review macro trends and the drivers behind them to understand tech trends related to your industry, then identify the most relevant and impactful ones for your company.

- Review and prioritize digital uses cases – Simply juxtaposing tech trends with strategic capabilities may reveal a list of use cases, but prioritizing those use cases ensures you leverage resources for maximum impact.

Develop Your Industry of the Future Report

Envision how digital can propel the transformation of your industry and your organization.

Analyst perspective

The "Industry of the Future" is not a vision for someday – it's here; it's now. Your business survival depends on anticipating change, not reacting to it.

In the 1990s, a leading camera maker dismissed digital photography as a niche fad. A decade later, its factories were silent while its competitors redefined the market.

More recently, in the 2010s, Intel – undisputed leader in processors at the time – underestimated the pace of mobile and foundries, ceding ground to TSMC and ARM-based chipmakers like Qualcomm, Apple, and NVIDIA.

These are not tales of bad companies but rather of great companies caught unprepared for the future.

The lesson endures: businesses don't collapse overnight – they are outpaced. Today, impacted by rapid technological developments, geopolitical disruptions, and demographic changes, every industry and sector stands at a similar crossroads. Each organization faces its own inflection point: AI, autonomous systems, and connected yet disrupted value chains are rewriting the rules.

The "Industry of the Future" is not a distant vision; it is unfolding in real time. To survive and lead, organizations must anticipate tech trends that may strengthen or weaken their business capabilities. But it shouldn't end there. Executive leaders must also identify opportunities and use cases by juxtaposing trends with strategic capabilities to align their innovation and transformation journey before the market demands it.

Manish Jain

Principal Research Director,

CIO Strategy

Info-Tech Research Group

Why the industry can't wait

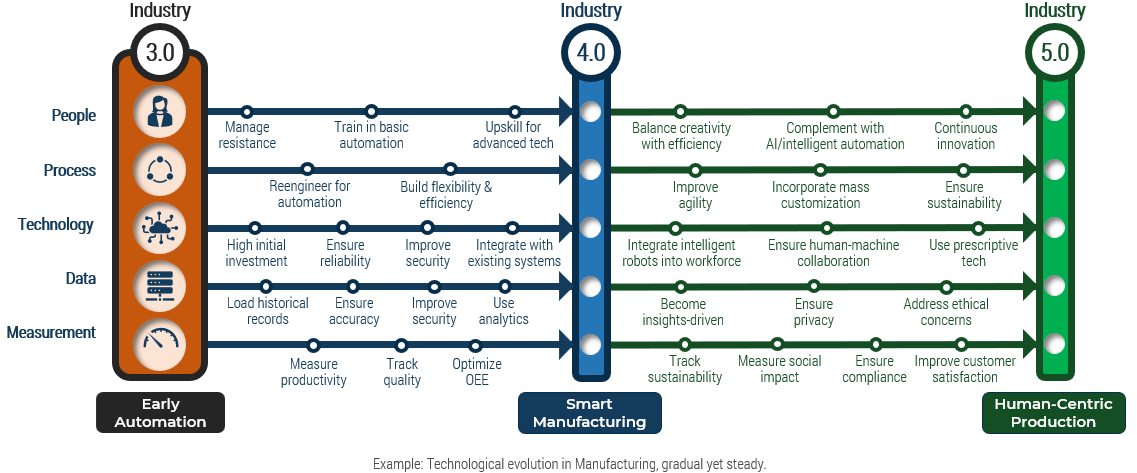

While some industries have led the digital transformation, asset-heavy industries, like Manufacturing, have been at the lagging end of it. Now, rapid changes in other industries will not let them be a spectator anymore.

Competition redefined:

- Global supply chain shocks

- Rising input costs

- Environmental, social, and governance (ESG) mandates

Evolving systemic pressures:

- AI-accelerated digital disruption

- Shifting customer expectations

- Regulatory and political pressures

- Talent and skills realignment

Disruption signals are everywhere:

- Shifting cost-based production to value-driven, customer-centric production.

- Maturing hybrid tech landscape – physical and digital (IoT, edge, digital twin, AI-integrated ops).

- Evolving ecosystem orchestration over traditional oligopolistic supply chains.

- Accelerating changes in regulatory, sustainability, and workforce dynamics.

Digital transformation may significantly impact all strategic KPIs. For Manufacturing, as an example, KPIs impacted include:

- Up to 20% Reduction in Inventory-Holding Cost

- Up to 30% Increase in Labor Productivity

- Up to 50% Reduction in Machine Downtime

- Up to 30% Increase in Throughput

- Up to 20% Reduction in Cost of Quality (CoQ)

- Up to 85% Improvement in Forecasting Accuracy

Source: "Capturing the True Value of Industry 4.0," McKinsey & Company, 2022.

All industries have evolved technologically

Some gradually yet steadily; a few others, rapidly and exponentially

Yet, progress on business transformation is fragmented and inconsistent

Islands of innovation without enterprise-wide orchestration

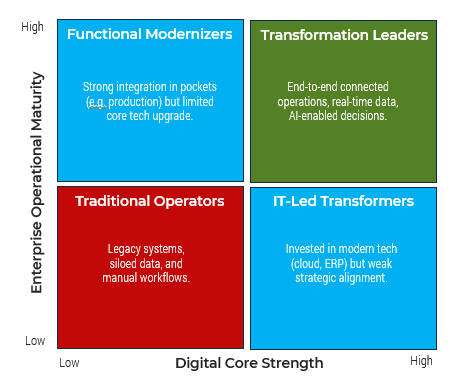

Despite years of digitalization efforts across organizations, the progress on the digital journey has been patchy and uneven:

At one end, some operate as globally integrated entities equipped with cloud, edge/IoT, AI, Gen AI, etc., while on the other end, many still rely on manual logs, spreadsheets, and legacy systems.

Maturity varies substantially across regions, functions, and business units. In most organizations, investments may be driven by IT but lack end-to-end transformation.

Reflect:

How would you rate your organization on operational maturity and digital core strength?

High

High

Business leaders shall envision the future not as a possibility but as an inevitability

Industry landscape that may emerge in 3-5 years:

- Traditional industry lines vanish as firms shift right to own customer relationships and extend left to control supply chains.

- Outcome-based pricing model and as-a-service operating models across multiple sectors.

- Closed-loop, circular systems driven by real-time data, minimizing greenhouse gas emissions.

- AI-powered, smart ecosystem of physical and digital realms.

- AI-augmented workforce where humans and machines collaborate seamlessly.

The emerging future will foundationally be driven by ecosystems, autonomous operations, and new customer experiences.

Too much is at stake

The next decade will not reward incrementalism.

Organizations that embrace the future will unlock exponential gains, while those clinging to legacy models may find themselves disintermediated or obsolete.

Exponential Rewards: Winners will reshape the industry.

Value Creation at Scale

Digital-first organizations will grow 2-4x faster than their peers by monetizing data, offering outcome-based services, and accessing new revenue streams.

Cost and Efficiency Curve Reset

Early adopters of AI, automation, and digital twins will achieve step-function transformation in productivity — not 5%, but 50%-70% faster cycle times, near-zero downtime, and radically leaner operations.

Strategic Control

Companies leading ecosystem orchestration — not just optimizing their own plant but shaping the supply and demand networks — will set new industry standards.

Existential Risks: Laggards will play catchup until irrelevancy.

Margin Erosion and Commoditization

Organizations that remain slow to evolve will be trapped in a race to the bottom – commoditized offerings, margin erosion, and high customer churn.

Digital Disintermediation

Platform-based entrants and agile startups may leapfrog incumbents by offering manufacturing-as-a-service, predictive supply chains, and direct-to-customer delivery.

Talent Flight

The best digital-native talent won't wait. Organizations failing to evolve will struggle to attract the future workforce.

This is a fork-in-the-road moment for traditional industry giants. Winners will reimagine the industry architecture, rewire how value is created and captured, and emerge as next-generation market-makers. Laggards? They risk becoming case studies of what went wrong.

This report is a guide for bold leadership not just to adapt but to shape the future of the industry

It is:

- Vision-driven but anchored in real-world shifts.

- Built by CIOs for executive leadership – CEOs and boards – to reinvigorate the discussion on digital innovation and transformation.

- Customizable for organization-specific capabilities and context.

It contains:

- Industry Capabilities Overview

- Technology Trends Shaping Your Industry

- Digital Opportunities/Prioritized Use Cases in Your Industry

- Next Steps on Your Innovation & Transformation Journey

This report aims to assist CxOs with a transformation mandate to evangelize the role of technology in the future of the organization and the industry.

Blueprint deliverable

At the end of this project, you will have created an executive presentation that is customized for your industry as well as for your organization.

Industry of the Future Report

Use your industry-specific template to customize an executive presentation for your own organization.

Develop the Industry of the Future Report Workbook

Use your industry-specific workbook to complete the activities in this storyboard and customize the report in the context of your industry, subindustry, and organization.

Phase 1

Identify Strategic Business Capabilities

Avoid draining resources by focusing on the capabilities most critical to achieving your strategic business goals.

Phase 1

1.1 Understand your strategic business goals

1.2 Identify top strategic business capabilities

Phase 2

2.1 Review tech trends impacting you

2.2 Map tech trends to top strategic business capabilities

Phase 3

3.1 Review digital use cases

3.2 Prioritize use cases

3.3 Customize the Industry of the Future Report

This phase will walk you through the following activities:

- Review your strategic business goals.

- Identify strategically critical business capabilities.

This phase involves the following participants:

- Chief Digital Officer or Chief Innovation Officer and/or CIO/CTO/Head of Technology

Step 1.1

Understand your strategic business goals

Activities

1.1.1 Review your strategic business goals

This step involves the following participants:

- Chief Digital Officer or Chief Innovation Officer and/or CIO/CTO/Head of Technology

Outcomes of this step

- Clear understanding of your organization's strategic business goals

Identify Strategic Business Capabilities

Step 1.1 > Step 1.2

Identify your organization's strategic goals

Gather your organization's business strategy documents and find information on:

- Business goals

- Business initiatives

- Business capabilities to create or enhance

(If your organization doesn't have this information documented, contact your Info-Tech Account Manager to get started.)

Interview the following stakeholders to uncover business context information:

- CEO

- CFO

Download the Business Context Discovery Tool.

Identify

Strategic Business Goals

Categorize in

Organizational Value Lever

Digital delivers value through multiple value levers

Value of Digital

Organizational Growth

Expanding the organization's products, services, or capabilities to ultimately drive revenue expansion through a new market, a new offering, or both.

Operational Efficiency

Reducing costs through operational performance improvements.

Beneficiary Experience

Customer Experience

Improving the customer experience with a product or service via reliability, engagement, transparency, etc.

Employee Experience

Optimizing the employee experience through changes that make work easier and more enjoyable, thus increasing job satisfaction.

Organizational Resilience

Risk and Sustainability

Mitigating diverse risk, safety, and continuity of operations concerns to preserve stable and sustainable performance.

Environment, Social, and Governance (ESG)

Improving environmental impacts, social and community wellbeing, and corporate governance practices.

Categorizing strategic business goals makes it easier to map the most valuable capabilities

Organizational Growth

- Expand into new geography.

- Increase market share.

- .............

Operational Efficiency

- Optimize supply chain logistics.

- Implement predictive maintenance.

- Automate production processes.

- Reduce plant cycle time.

- Reduce or eliminate late WIP.

- .............

Beneficiary Experience

Customer Experience

- Enhance product customization capabilities.

- Improve delivery accuracy and speed.

- Establish customer feedback loops.

- .............

Employee Experience

- Upskill workforce on digital.

- Improve workplace safety and ergonomics.

- Foster a culture of innovation.

- .............

Organizational Resilience

Risk and Sustainability

- Diversify supplier base.

- Adopt circular manufacturing practices.

- .............

ESG

- Reduce carbon footprint.

- Ensure ethical sourcing.

- Increase transparency in ESG reporting.

- .............

Activity 1.1.1 Review your strategic business goals

3 hours

- Review your organization's business strategy documentation to gather its vision, mission, and goals – the strategic north stars.

- Use the Business Context Interview Guide to interview executive leaders to assess their interpretation of the strategic north stars.

- Synthesize their inputs, identify any gaps, and have a second round of discussions to close those gaps.

- Categorize the strategic business goals into the value levers introduced on the previous slides (Organizational Growth, Operational Efficiency, Customer Experience, Employee Experience, Risk and Sustainability, and ESG).

- Pick the most important value lever for the next exercise.

Download the Business Context Interview Guide.

| Input | Output |

|---|---|

|

|

| Materials | Participants |

|

|

Step 1.2

Identify top strategic business capabilities

Activities

1.2.1 Identify strategically critical business capabilities

This step involves the following participants:

- Chief Digital Officer or Chief Innovation Officer and/or CIO/CTO/Head of Technology

Outcomes of this step

- 10-15 strategically critical business capabilities

Identify Strategic Business Capabilities

Step 1.1 > Step 1.2

Begin with understanding your industry's generic value streams

Example Value Streams: Manufacturing Industry

Design Product

- Manufacturers proactively analyze their respective markets for any new opportunities or threats.

- They design new products to serve changing customer needs or to rival any new offerings by competitors.

- A manufacturer's success depends on its ability to develop a product the market wants at the right price and quality level.

Produce Product

- Optimizing production activities is an important capability for manufacturers. Raw materials and working inventories need to be managed effectively to minimize wastage and maximize use of the production lines.

- Processes need to be refined continuously over time to remain competitive, and the quality of the materials and final products needs to be strictly managed.

Sell Product

- Once the product is produced, manufacturers need to sell the products. This is done through distributors and retailers and, in some cases, directly to the end consumer.

- To complete the sale, manufacturers typically have to deliver the product, provide customer care, and manage complaints.

- Manufacturers also randomly test their end products to ensure they are meeting quality requirements.

After-Sale Support

- Once the product is sold, manufacturers need to consider how they will handle the relationships with customers and channels. This includes:

- Measuring satisfaction

- Returns management

- Capturing enhancements and putting them into R&D

- Product replacement

- Product enhancement

- Invoicing

- Collections

- Service and repairs

Value Streams Defined:

Value streams connect business goals to the organization's value realization activities in the marketplace. Those activities are dependent on the specific manufacturing industry segment (discrete, continuous, etc.) in which the organization operates.

There are two types of value streams: core value streams and support value streams.

- Core value streams are mostly externally facing. They deliver value to either an external or internal customer, and they tie to the customer perspective of the strategy map.

- Support value streams are internally facing and provide the foundational support for an organization to operate.

An effective method for ensuring all value streams have been considered is to understand that there can be different end-value receivers.

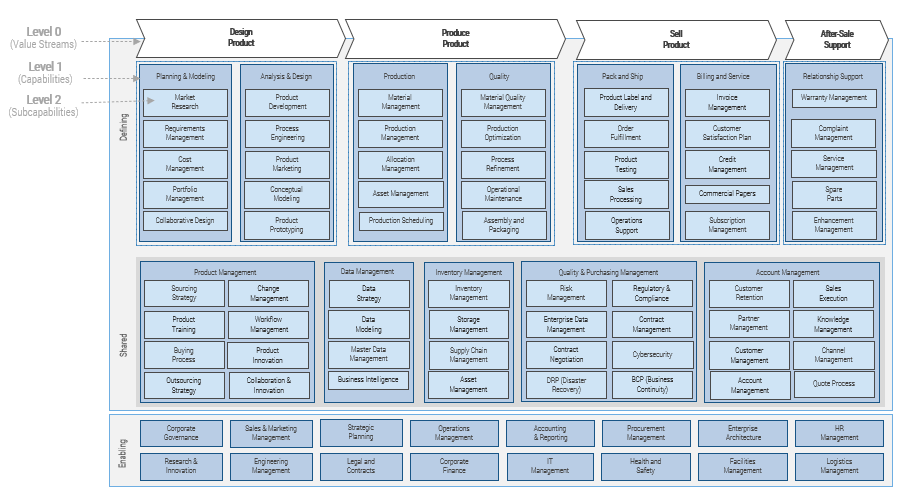

Leverage the standard industry business capability map to fine-tune your strategic focus

Business capability map defined

In business architecture, the primary view of an organization is known as a business capability map.

A business capability defines what a business does to enable value creation rather than how. Business capabilities:

- Represent stable business functions.

- Are unique and independent of each other.

- Typically have a defined business outcome.

A business capability map provides details that help the business architecture practitioner direct attention to a specific area of the business for further assessment.

Example: Industry Reference Architecture for Manufacturing

Navigate the Digital ID Ecosystem to Enhance Customer Experience

Navigate the Digital ID Ecosystem to Enhance Customer Experience

Document Business Goals and Capabilities for Your IT Strategy

Document Business Goals and Capabilities for Your IT Strategy

Build a Business-Aligned IT Strategy

Build a Business-Aligned IT Strategy

Define Your Digital Business Strategy

Define Your Digital Business Strategy

Drive Digital Transformation With Platform Strategies

Drive Digital Transformation With Platform Strategies

Make IT a Partner in Successful M&A Due Diligence

Make IT a Partner in Successful M&A Due Diligence

Make IT a Successful Partner in M&A Integration

Make IT a Successful Partner in M&A Integration

Plan Your Digital Transformation on a Page

Plan Your Digital Transformation on a Page

Review Your Application Strategy

Review Your Application Strategy

Start Making Data-Driven People Decisions

Start Making Data-Driven People Decisions

2021 CIO Priorities Report

2021 CIO Priorities Report

Create a Work-From-Anywhere Strategy

Create a Work-From-Anywhere Strategy

Mergers & Acquisitions: The Sell Blueprint

Mergers & Acquisitions: The Sell Blueprint

Mergers & Acquisitions: The Buy Blueprint

Mergers & Acquisitions: The Buy Blueprint

CIO Priorities 2023

CIO Priorities 2023

Communicate Any IT Initiative

Communicate Any IT Initiative

Effective IT Communications

Effective IT Communications

Establish an Integrated IT-Business Operating Model

Establish an Integrated IT-Business Operating Model

Info-Tech Quarterly Research Agenda Outcomes Q2/Q3 2023

Info-Tech Quarterly Research Agenda Outcomes Q2/Q3 2023

Business Vision Diagnostic – Annual IT Improvement Program

Business Vision Diagnostic – Annual IT Improvement Program

Establish Your Digital Transformation Governance

Establish Your Digital Transformation Governance

Info-Tech Quarterly Research Agenda Outcomes Q4 2023

Info-Tech Quarterly Research Agenda Outcomes Q4 2023

Master Your Change Story for Digital Transformation

Master Your Change Story for Digital Transformation

Info-Tech’s Best of 2023: The Year IT Reached an Inflection Point

Info-Tech’s Best of 2023: The Year IT Reached an Inflection Point

Prepare for AI Regulation

Prepare for AI Regulation

Crack the Code to Successful Transformation Management

Crack the Code to Successful Transformation Management

Info-Tech Diagnostics: Identify and Leverage Your Strengths

Info-Tech Diagnostics: Identify and Leverage Your Strengths

The CIO Playbook: 8 Secrets and 12 Steps to Systematically Achieve IT Excellence

The CIO Playbook: 8 Secrets and 12 Steps to Systematically Achieve IT Excellence

Develop an M&A IT Playbook

Develop an M&A IT Playbook

Adapt to Uncertainty With a Technology-First Action Plan

Adapt to Uncertainty With a Technology-First Action Plan

Digital Transformation: A Revolution That Lost Its Way

Digital Transformation: A Revolution That Lost Its Way

The CIO Playbook

The CIO Playbook

The Essential IT Playbook

The Essential IT Playbook

Visualize the Industry of the Future

Visualize the Industry of the Future

CIO Priorities 2026

CIO Priorities 2026