Volatile oil prices, coupled with increased competition from renewable energy sources, have complicated planning and investment. The changing environment makes allocating capital difficult for multi-year time horizons and major technology initiatives.

New regulations are escalating required monitoring and compliance efforts. Companies must invest in robust systems to meet these demands, while also addressing the rising expectations for sustainability and transparency in their operations.

Choosing which emerging technologies and trends to invest in creates challenges and tensions for oil and gas organizations, particularly when these innovations have the potential to disrupt existing operational technologies (OT).

Our Advice

Critical Insight

The oil industry of the future will leverage technology trends across the entire operational lifecycle and benefit from the mutual reinforcement of the technologies and their value. Creating implementation plans that are scalable and holistic before starting pilot initiatives is of paramount importance.

Impact and Result

- Perform a broader scan to highlight the demonstrated and relevant trends in technology services.

- Help organizations understand the trends to navigate the opportunities and challenges of tomorrow.

- Highlight the impacts of the trends on both provider businesses and their customers.

- Guide organizations through actionable recommendations and next steps.

The Future of Oil and Gas Trends Report

An industry strategic foresight trends report.

Analyst Perspective

Build your foundations now, because it will only get more complicated from here.

The oil and gas industry is at the precipice of a holistic technology acceleration. The market sizes and adoption rates of what were once cutting-edge solutions are quickly increasing, and the synergies between many of these technologies are mutually reinforcing their adoption. In order to foster success, operators must invest in the foundational IT competencies that underpin these trends today and think strategically about opportunities to scale in the future.

This report is designed to equip industry leaders with actionable intelligence by highlighting critical trends including the industrial internet of things (IIOT), advance analytics for decision-making, intelligent automation, and sustainability technology. By analyzing these trends and the implications they have on companies, this report will offer clarity on best courses of action to ensure your organization is capable of both adopting and driving business-aligned value through these technologies.

Info-Tech’s approach focuses on an analyst’s investigation of strategic foresight, a methodology that helps the IT department process what is happening in the external environment to guide ideation and opportunity identification. As a methodology, strategic foresight flows from the identification of signals to clustering them together to form trends and allow for the exploration of the driver behind those trends. This will determine which strategic initiatives are most likely to lead to success both at an industry level and specifically in your business. It will also enable structured, value-driven planning of the initiatives you pursue as you evolve your digital oil field.

Evan Garland

Research Analyst

Oil and Gas Industry

Info-Tech Research Group

Executive summary

Your Challenge

Volatile oil prices, coupled with increased competition from renewable energy sources, have complicated planning and investment. The changing environment makes allocating capital difficult for multi-year time horizons and major technology initiatives.

New regulations are escalating required monitoring and compliance efforts. Companies must invest in robust systems to meet these demands, while also addressing the rising expectations for sustainability and transparency in their operations.

Choosing which emerging technologies and trends to invest in creates challenges and tensions for oil and gas organizations, particularly when these innovations have the potential to disrupt existing operational technologies (OT).

Common Obstacles

The complexities of emerging trends cause friction in defining benefits and strategic direction to achieve a measurable ROI.

The traditional implementation of isolated and small initiatives limits the value and ability to scale, whereas trending technology solutions work best when interconnected.

Effective change management and generating buy-in from leadership require a solid understanding of the current technology use cases and implementations.

Info-Tech’s Approach

Conduct a comprehensive scan to identify and highlight the demonstrated and relevant trends in technology services.

Help organizations understand the trends to navigate the opportunities and challenges of the future.

Highlight the impacts of the trends on stakeholder groups including IT, OT, and business leaders.

Guide organizations through actionable recommendations and next steps.

Info-Tech Insight

The oil industry of the future will leverage technology trends across the entire operational lifecycle and benefit from the mutual reinforcement of the technologies and their value. Creating implementation plans that are scalable and holistic before starting pilot initiatives is of paramount importance.

Modernize your operations and prepare for a future that builds upon present technology

In the past, the oil and gas industry has taken time to move beyond hardware-focused innovation to enable greater productivity and cost efficiency. But the modern operator must embrace an interconnected and data-driven technology environment to remain competitive and prepare for continued progress.

The Past

- Oil and gas operations relied on siloed, manual processes, with paper-based tracking and fragmented systems limiting visibility and responsiveness.

- SCADA and DCS systems enabled basic remote monitoring, but insights were delayed and data streams were rarely integrated for real-time decision-making

- Technology investment focused on hardware over intelligence, prioritizing mechanical performance over digital optimization or automation.

The Present

- Digital technologies are modernizing operations, with AI, IoT sensors, and real-time analytics enhancing drilling operations, maintenance strategies, and safety.

- Emissions tracking and sustainability reporting are growing priorities as environmental protections become stronger and stakeholder groups seek greater transparency into sustainable operations.

- Workforce augmentation and automation is gaining momentum, as companies seek to address labor shortages, skills gaps, and safety concerns while also becoming more efficient.

The Future

- Operations for multiple functions and processes will move toward full autonomy, with AI-driven drilling, robotic inspections, and unmanned production facilities operating with minimal human oversight.

- Data mastery will define competitive advantage, as firms that unify asset, geological and environmental data will outpace peers in agility, compliance, and resource recovery.

- Remote-first field models will become the norm, with centralized operations centers controlling fleets of sensors, drones, and autonomous equipment across geographically dispersed assets.

The future of the industry: What trends are shaping future business opportunities?

Seize opportunities to enable the business through technology solutions

Oil and Gas companies that lean into industry tech trends will be rewarded with progress in valuable areas.

Business Enablers

Cost Optimization

Leveraging analytical tools and automation enables companies to optimize resource allocation, reduce human labor, and choose cost effective courses of action faster and more accurately.Sustainability Adoption

Companies with mature sustainability practices are both more attractive to a broader base of investment stakeholders and more insulated from setbacks in a constantly changing regulatory environment.Operational Growth

Leveraging and scaling technology to support greater production outputs becomes more sustainable and cost-effective, the more automated your operations are.

The Future of Oil & Gas Trends Report

The oil industry of tomorrow will leverage technology trends across the entire operational lifecycle, allowing cost, output, and sustainability to be optimized.

Evolve your digital oil field

Embracing the Industrial Internet of Things |

Embedding Sustainability Technology |

Leverage Intelligent Automation in Operations |

Enhancing Decision-Making With AI and ML Models |

|

Reason |

The desire for greater control over operations comes with a demand for more available and accurate data. | Sustainability initiatives support investor satisfaction, maintaining compliance, and minimizing costs. | Advanced technology capabilities continue to evolve, offering new ways to automate and optimize operations. | Your business and operational leaders don’t have unlimited time to analyze every decision. |

Impact |

|

|

|

|

Use Cases |

|

|

|

|

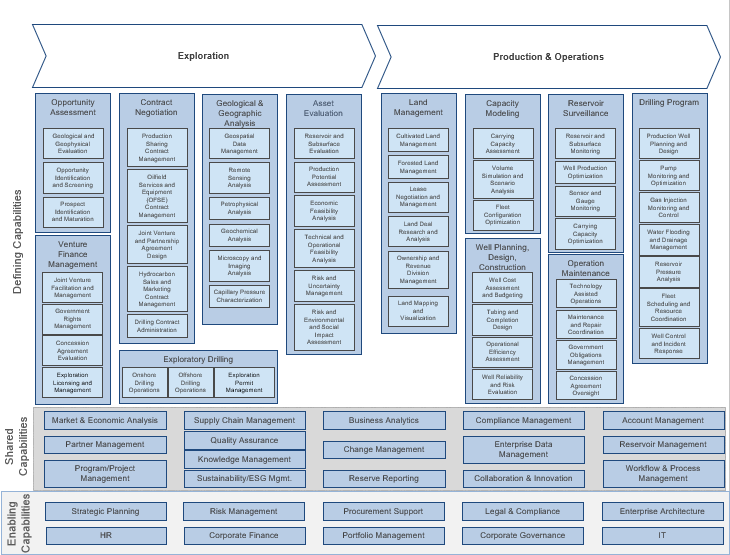

Identify cost and competitive advantages with capability maps

Note: Illustration of the Oil and Gas Business Reference Architecture.

In business architecture, the primary view of an organization is known as a business capability map.

A business capability defines what a business does to enable value creation, rather than how. Business capabilities:

- Represent stable business functions.

- Are unique and independent of each other.

- Typically, will have a defined business outcome.

The business architecture practitioner can use this map to assess a specific area of the business.

Download the Reference Architecture for Oil & Gas Template

How to use this report

Leverage this trends report to develop your digital business strategy

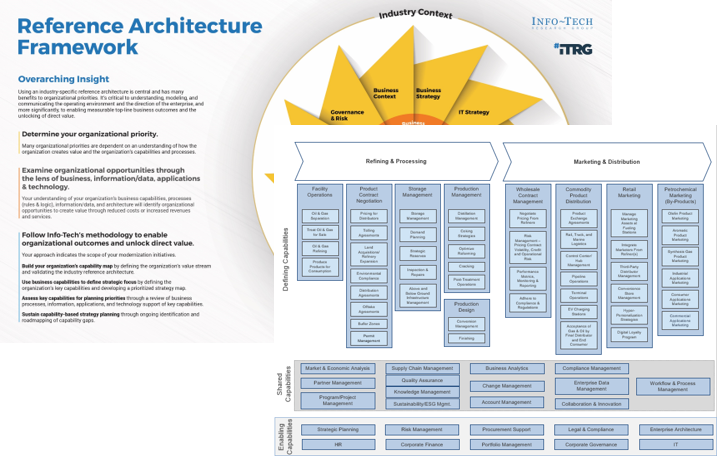

This report is intended to act as a standalone report on oil and gas technology trends to assist with effectively process signals in your environment and build an understanding of relevant trends. It can also serve as a research-based accelerated input to the Define Your Digital Business Strategy and IT Strategy blueprints and associated activities.

The future of the Oil and gas industry — Trends Report

Leverage this trends report for priorities that drive measurable, top-line organizational outcomes and to unlock direct value.Business context & IT Strategy

The future will bring more trends and technologies. Your organization must establish itself as the disrupter, not the disrupted. You must establish a structured approach to innovation management that considers external trends and internal processes.

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit |

Guided Implementation |

Workshop |

Executive & Technical Counseling |

Consulting |

| “Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.” | “Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.” | “We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.” | “Our team and processes are maturing; however, to expedite the journey we'll need a seasoned practitioner to coach and validate approaches, deliverables, and opportunities.” | “Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.” |

Diagnostics and consistent frameworks are used throughout all five options. |

||||

Deliverables

Our Oil and Gas Business Reference Architecture, Oil and Gas Trend Canvas Template, and Oil and Gas Trend Foresight Tool will enable you to grasp the impact of these trends on your organization and prioritize and communicate them to your C-suite sponsors in terms of the value they provide.

Each step of this research is accompanied by supporting deliverables to help you accomplish your goals:

Reference Architecture for Oil & Gas Template

Use our reference architecture to define your business capabilities and assess their relevance to each trend.

Oil and Gas Trend Canvas Template

Assess each trend and its relevance to your organization in a single canvas.

Oil and Gas Trend Foresight Tool

Compile and display the information about each trend to confidently prioritize which trends your company should focus on.

INFO~TECH RESEARCH GROUP

Industrial Internet of Things (IIOT)

TREND 1

Prepare your technology foundations for a truly digital oil field with a high visibility network that will transform your operations.

Create the bedrock for a digital oil field with the Industrial Internet of Things

IIOT technology and sensor networks are the foundation for digital progress. The implementation of automation, advanced analytics, and sustainability initiatives is all directly dependent on operational data. Constructing a reliable network of sensors that produces accurate data from field operations is essential to allowing modern operators to continue technology innovation.

Maximum visibility provides maximum potential for insight. Even before advanced technology layers are implemented, continuous and reliable visibility into operations creates more informed decision-making. Clearer baselines for performance allow for better judgment and action on a human level, and greater long-term adaptability to processes to suit the conditions in the field.

Benefits come not just from the data itself, but from how it’s collected. Remote sensor networks eliminate the need for manual inspection and other field services, allowing organizations to collect real-time data from hard-to-access or hazardous environments. This not only reduces labor costs and human exposure to risk but also creates more reliable and consistent data that can be used to further improve operational safety and decision-making.

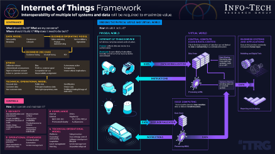

Digital Oil Field Explained

The digital oil field represents the convergence of multiple innovation initiatives spanning automation, advanced analytics, AI, and cloud-based collaboration. Collectively, these technologies enable more efficient and effective upstream, midstream, and downstream operations. At the heart of it all is data collected from physical assets and processes. This operational data layer is made possible by IIoT technologies, which deploy sensors and smart devices to capture the information used as inputs to larger and more advanced initiatives.

As sensor networks scale across assets, they lay the groundwork for advanced analytics and automation in subsequent phases of digital transformation.

THE FOOTPRINT OF IIOT IS GROWING RAPIDLY

18.8 million — The installed base of wireless IIOT devices is expected to exceed 18.8 million worldwide, an increase of over 140% from the 7.8 million installed as of 2023. (Source: Business Wire, 2024)

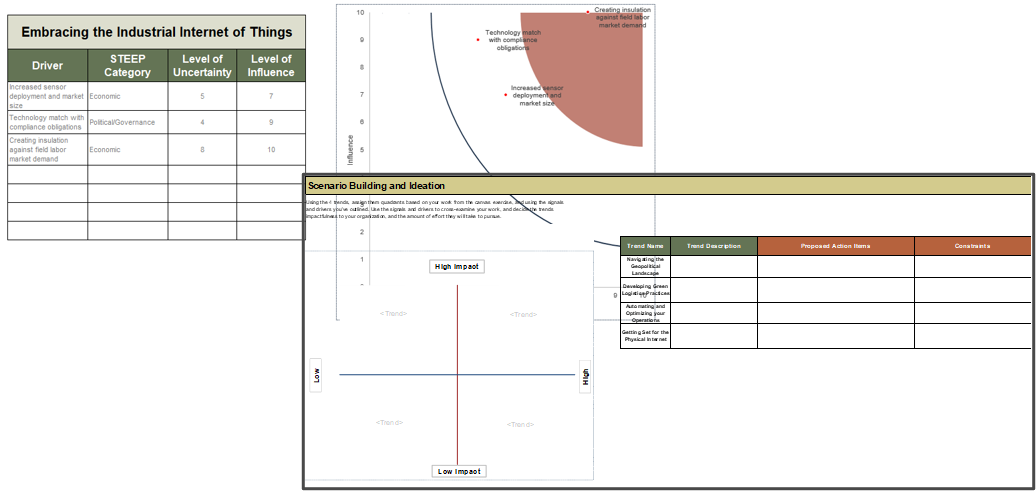

Signals

WHAT WE ARE SEEING

Deployment numbers projected to skyrocket, backed by regulatory and efficiency demands.

Sensor deployment is spiking and showing no signs of slowing down. The Global IoT Sensors Market for Oil and Gas is expected to grow from $476 million in 2024 to $9.37 billion in 2034, representing a CAGR of nearly 35% from 2025 to 2034.

Regulatory pressure provides few alternatives for compliance. The introduction of the 2024 methane emission rules in the US has effectively mandated continuous monitoring to meet the requirement thresholds.

Creating efficiency is a necessity to weather the field labor market conditions. Increased IIOT deployment directly impacts the number of onsite staff hours required for operations. This provides insulation against skill shortages in the labor market and boosts retention by reducing exposure to dangerous work conditions for existing staff.

(Sources: Market.us, 2025; Vinson & Elkins LLP, 2024)

IMPACTED CAPABILITIES

The capabilities that have been listed and highlighted below receive a cost or competitive advantage through using IIOT technology.

Competitive Advantage

- Well Control and Incident Response

- Technology Assisted Operations

- Volume Simulation and Scenario Analysis

- Carrying Capacity Assessment

Cost Advantage

- Pump Monitoring and Optimization

- Maintenance and Repair Coordination

- Fleet Scheduling and Resource Coordination

- Sensor and Gauge Monitoring

Drivers

WHY YOU SHOULD CARE

- Operational Excellence: The technology allows for a greater volume of operational data than ever possible before, exposing opportunities for cost-effective management of assets, operational resources, and much more.

- Business Growth: IIOT lays the foundation for autonomous operations and detailed statistical analysis that can maximize your production output.

- Sustainability: Improving your sustainability profile starts with the accurate measurement of emissions and resource usage. IIOT technology provides granular and frequent data that can be used to power sustainability initiatives.

Act on opportunities, prepare for challenges

Opportunities

Cost Savings

Real-time sensor data enables more efficient use of equipment and energy, leading to lower operating costs.Safety and Environmental Monitoring

IIoT technologies (including wearables and remote sensors) improve worker safety and environmental protection by detecting hazardous conditions early and removing the need for placing human personnel from dangerous areas or tasks.Visibility and Data Driven Insights

The vast volumes of data collected by IIoT devices can be analyzed for actionable insights, improving decision-making and reporting.

Challenges

Legacy Systems and Interoperability

Many oil field assets and control systems are decades old, and integrating new IoT devices with these legacy systems is complex. Ensuring new sensors, software platforms, and existing OT (operational technology) work together often requires significant custom engineering and coordination on industry data standards.Cybersecurity

Connecting formerly isolated industrial systems to the internet greatly expands the digital attack surface. Protecting these systems is paramount to avoiding production or safety incidents.Connectivity Constraints

Many upstream operations occur in remote regions (offshore, deep fields) with limited communications infrastructure. Investment in private networks, satellite links, or edge computing solutions to cope with connectivity limitations in the field.

Know the answers to the questions you’ll get from impacted groups

IT leaders

“What specific responsibilities will fall to IT as our organization deploys more IIoT across field operations?”

Three areas where your role is set to expand are: infrastructure building to support the IIOT network, system integration, and joint cybersecurity efforts with OT. To see success in IIOT implementation, your environment needs to be provisioned with the resources to handle a more complex data ecosystem, be interoperable with both IT and OT systems, and remain secure despite additional points of attack.

“What’s the best way for IT to prepare our data and architecture for a surge of sensor-driven operational data?”

Defining a clear data strategy and data governance policy will be essential. The more data that is improperly ingested by your environment, the more value will be lost from the system, and the more difficult it will be to scale going forward.

Operational/OT Leaders

“What will change about how we monitor and maintain equipment as IIoT becomes more embedded in field operations?”

Existing responsibilities for physical device maintenance will be supplemented by the need to monitor firmware and validate data. Close collaboration with IT is necessary to ensure the expected benefits are being delivered.

“How do we ensure that IIoT devices and platforms meet our safety and reliability requirements in the field?”

Developing robust field readiness criteria for use in deployment is an important step. More broadly, planning to support the digital lifecycle of devices in addition to their physical lifecycle will also be a necessity, and IT will be an important partner in the creation of this process.

Corporate Leaders

“What business outcomes should we expect from investing in IIoT, and how soon can we see value?”

Depending on your existing infrastructure support for IIoT, there may be a period of infrastructure development required before the implementation of value-producing use cases. But once achieved, you can expect to see cost savings created by less unplanned downtime and extended asset life, and more stable performance baselines driven by increased prediction capabilities.

“What risks or barriers could prevent us from realizing ROI on IIoT initiatives?”

Deployments that don’t have a direct, KPI-driven outcome can easily drift away from scope and siphon away projected value. Also, any IIoT initiative will fall flat without sufficient support from and cooperation between the IT and OT personnel groups.

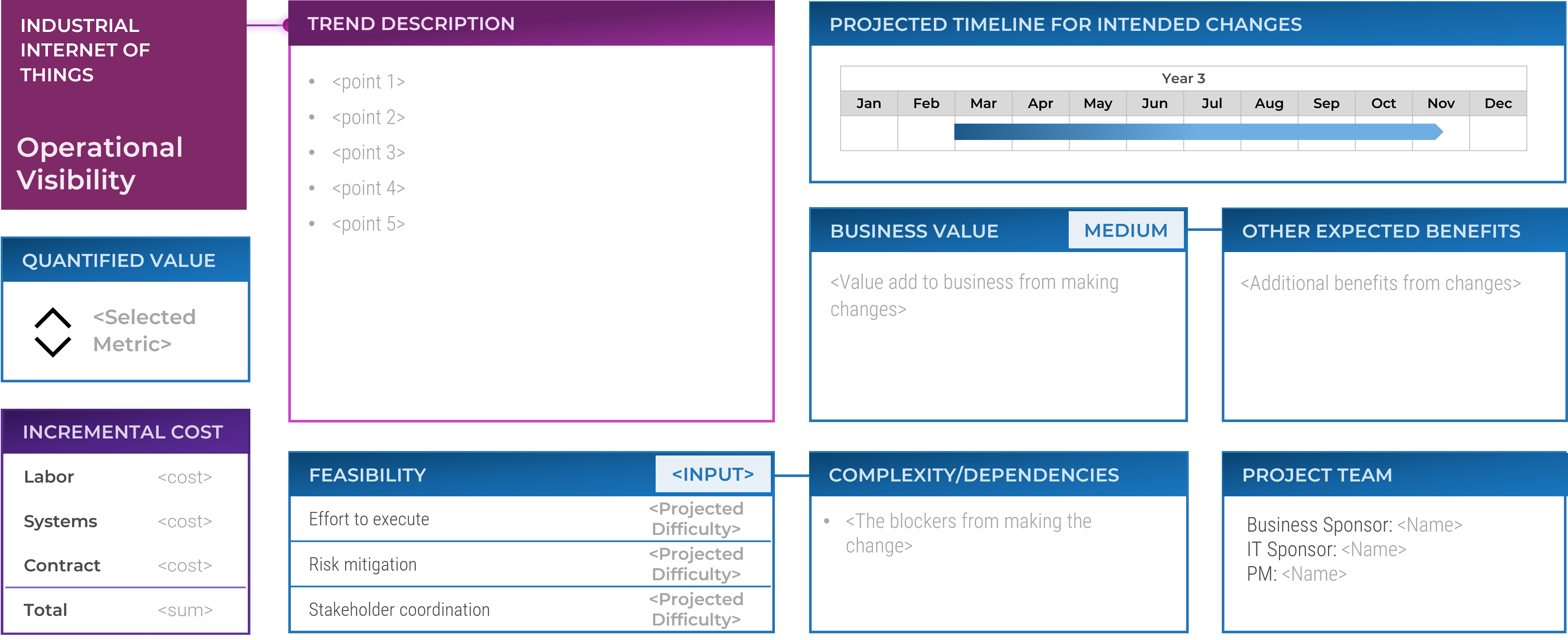

1.1 Evaluate the organizational impact of the Industrial Internet of Things

Input: Business goals, Business initiatives, Trend impact understanding

Output: Business aligned trend canvas

Materials: Collaboration/brainstorming tool (whiteboard, flip chart, digital equivalent), Oil and Gas Trend Canvas Template

Participants: CIO, Other IT leadership, COO, CEO, Other relevant stakeholders, as necessary

- Gather the appropriate executive decision-makers and discuss the validity of the trend and how it will impact your organization.

- Using the Oil and Gas Trend Canvas Template, brainstorm what changes would need to be made, documenting them within the trend description. Assess the value it would bring to your organization, and the expected benefits, inputting the outcomes into their respective location.

- Discuss the feasibility of making these changes, on a scale of Low (Very simple, minimal amounts of effort), Medium (considerably challenging, will take time), High (Very challenging and lengthy process) and assign them to the given categories. Discuss what would make these changes complex.

- Assign a potential project team for pursuing this trend that will make the changes. Discuss the timeline for when changes would like to be made and estimated costs.

- Decide on a given metric, to quantify success from this change. Creating a performance indicator will assist your company in ensuring the changes are being made for the right reasons.

Download the Oil and Gas Trend Canvas Template

Sample – fit for use case

Example:

Trend: Industrial Internet of Things

Prepare for change through an open, intelligent, hyper connected network that will transform your operations.

Note: Illustrative example derived from empirical research.

From priorities to action

Recommendations

- Prioritize high-value IIoT use cases. Focus on IoT projects with clear ROI (e.g. predictive maintenance, asset tracking) to demonstrate quick wins. Innovative digital use cases that drive efficiency and have a direct impact on KPI’s will generate valuable buy-in for further progress.

- Integrate IIoT into core strategy. Treat IIoT deployments as a strategic capability, not isolated pilots. Conduct upfront planning to ensure IoT solutions are scalable and maintainable, rather than ad hoc projects.

- Harness IIoT data for insights. Build data management and analytics pipelines to convert vast sensor data into actionable intelligence. With the enormous amount of data generated, simple but effective governance and consolidation can unlock value even without additional layers of technology processes.

- Focus on digital transformation. Ensure your company is pursuing its digital transformation so you may have the necessary infrastructure to support the IIoT.

Helpful resources from Info-Tech

The large volume of IoT devices and lack of insight into vendor solutions make it hard for IT and the business to manage the lifecycle and guarantee security protocols are being met. Start at the assessment phase to onboard IoT solutions into your environment. Create and Implement an IoT Strategy

Create and Implement an IoT Strategy

Understanding how IoT applications will create value in your firm enables strategic planning and prioritization of IoT initiatives. Understand and Apply IoT Use Cases to Drive Organizational Success

Understand and Apply IoT Use Cases to Drive Organizational Success

Unlock the full potential of your infrastructure with a digital transformation strategy and clear the barriers to success. Assess Infrastructure Readiness for Digital Transformation

Assess Infrastructure Readiness for Digital Transformation

INFO~TECH RESEARCH GROUP

Analytics for Decision-Making

TREND 2

Accelerate your data analytics capabilities by analyzing greater volumes of data and getting informed insights to support decision-makers across the organization.

Harness the full potential of your data

The more common advanced analytics use cases have a well-established value. Predictive maintenance and modeling have demonstrated substantial positive returns across industries beyond oil and gas. McKinsey has reported cost reductions in the range of 10% to 40% across varying implementations (WorkTrek, 2025).

Large players in the market are investing in new analytical applications. BP Oil has stated that AI has sped up the analysis of seismic data in the Gulf of Mexico from 6-12 months to just 8-12 weeks (“CERAWEEK AI leading,” Reuters, 2025). BCG has indicated that AI-supported decision-making for production engineers could lead to production uplifts between 5% to 10% if implemented at scale.

The need for improved analytics will only increase as data volume increases. Modern drilling platforms generate massive amounts of data on an annual basis and can reach totals of up to 15 petabytes over their lifespan (Computools, 2025). The scale of data processing and analytics required to fully utilize this data is infeasible without developed pipelines and models in place.

36% — Only 36% of oil and gas companies have made investments that support big data analytics. (Source: Computools, 2025)

24% — Only 24% of oil and gas companies classify their maintenance strategy as “predictive.” (Source: UptimeAI, 2024)

Analytics and AI-driven use cases are primed for continued expansion, driven by growth in both the value and volume of data from operations. Careful planning will be essential to managing this influx effectively.

AI USAGE IS EXPANDING FAST

50% — When surveying over 100 firms within its district in June 2024, the Dallas Fed reported that 50% were either already using AI or planning to do so in the next 12 months. Usage was even more common among firms producing over 10,000 barrels per day. (Source: Dallas Fed Survey, 2025)