As an insurance company, you may be facing several challenges:

- Your insurance company has been complacent, and decades of inaction have resulted in serious challenges with legacy systems, processes, and data.

- Competitors are reshaping all aspects of the value stream.

- Your company is struggling to keep up. Competitors are using modern technology stacks and advanced capabilities to deliver innovative new products and services.

- Your customers expect new, innovative, and easy-to-use products. Insurtechs and incumbents who have invested in technology modernization are rapidly out-innovating you.

Our Advice

Critical Insight

The insurance industry has already gone through a period of rapid change that has resulted in many companies falling further behind. Exponential IT is an opportunity for your company to adopt new technologies and capabilities that will allow it to compete more effectively with more advanced incumbents and insurtechs.

Impact and Result

- Recognize the urgency of adopting Exponential IT. Your insurance company must start the conversation on how Exponential IT is changing the industry and begin making the significant changes required to adopt it.

- Consider the four priorities of Exponential IT transformation. There are four areas of focus that you must focus on as your insurance company develops its Exponential IT capabilities.

- Build the foundational capabilities and maturity required to begin an effective Exponential IT transformation that will propel your company to the forefront of the insurance industry.

Priorities for Adopting an Exponential IT Mindset in the Insurance Industry

Adopting Exponential IT is essential to enabling the future of your insurance organization.

Analyst Perspective

Enable value creation through Exponential IT

Information technology has radically transformed organizations, from the computerization of operations to the digital transformation of service models. As technological disruption accelerates exponentially, a world of exponential opportunity is within reach. To capitalize on this upcoming opportunity, IT leaders will have to become business leaders who unlock advanced value for the organization and help mitigate exponential risk through an Exponential IT transformation. However, uncertainty surrounds innovation readiness in the realm of Exponential IT, requiring new skills and capabilities.

The insurance industry needs to urgently adopt Exponential IT to counter industry disruptions. Understanding four key priorities of exponential IT transformation is crucial for competitiveness. Additionally, recognizing and incorporating foundational capabilities is essential to initiate an effective Exponential IT transformation, leading to value creation within the industry.

David Tomljenovic, MBA, LL.M, CIM

Head of Financial Services Industry Research

Info-Tech Research Group

Executive Summary

Your ChallengeYour insurance company has been complacent, and decades of inaction have resulted in serious challenges with legacy systems, processes, and data. Competitors are reshaping all aspects of the value stream. Your company is struggling to keep up. Competitors are using modern technology stacks and advanced capabilities to deliver innovative new products and services. Your customers expect new, innovative, and easy-to-use products. Insurtechs and incumbents who have invested in technology modernization are rapidly out-innovating you. |

Common ObstaclesYour legacy systems are consuming your resources and further challenging innovation. Most of your IT budget is spent on old systems, causing you to fall further behind. Your data is trapped in siloed legacy systems and is difficult to access and often poor quality. You need customer and product information more than ever, but your data is hard to access, outdated, and of poor quality/accuracy. Some of your most important employees are starting to retire. Your legacy systems are extremely complex and written/running on old technologies that require specialized IT talent who are retiring and are not being replaced. |

Info-Tech’s ApproachRecognize the urgency of adopting Exponential IT. Your insurance company must start the conversation on how Exponential IT is changing the industry and begin making the significant changes required to adopt it. Consider the four priorities of Exponential IT transformation. There are four areas of focus that you must focus on as your insurance company develops its Exponential IT capabilities. Build the foundational capabilities and maturity required to begin an effective Exponential IT transformation that will propel your company to the forefront of the insurance industry. |

Info-Tech Insight

The insurance industry has already gone through a period of rapid change that has resulted in many companies falling further behind. Exponential IT is an opportunity for your company to adopt new technologies and capabilities that will allow it to compete more effectively with more advanced incumbents and insurtechs.

Info-Tech Research Group: EXPONENTIAL IT

What is Exponential IT?

Exponential IT is a framework defined by Info-Tech Research Group.

The technology curve has recently bent exponentially.

Generative AI has been the catalyst for this sudden shift, but there are more and more new technologies emerging (e.g. quantum computing, 5G), putting significant pressure on all organizations.

Speed is now imperative. All IT leaders and organizations are at risk of falling behind if they do not adopt new technologies fast enough.

Our framework instructs all IT leaders on how to transform their organization and elevate their value-creation capabilities, to close the gap between the exponential progression of technological change and the linear progression of IT’s ability to successfully manage that change.

This research allows IT leaders to understand the industry-specific priorities for Exponential IT and begin an effective Exponential IT transformation, resulting in value creation.

Your Exponential IT Journey

To keep pace with the exponential technology curve, adopt an Exponential IT mindset and practices. Assess your organization’s readiness and embark on a transformation journey. This report will provide greater insights to help you build your Exponential IT Roadmap.

To access all Exponential IT research, visit the Exponential IT Research Center

Go to this link

Adopt an Exponential IT Mindset

Focus of this report

Info-Tech resources:

Exponential IT Research Center

, Research Center

Overview

, and

Keynote

Explore the Art of the Possible

Info-Tech resources:

Exponential IT research blueprints

for nine IT domains

Gauge your Organizational Readiness

Repeat Annually

Info-Tech resource:

Exponential IT Readiness Diagnostic

Build an Exponential IT Roadmap

Repeat Annually

Info-Tech resource:

Develop an Exponential IT Roadmap

blueprint

Embark on Your Exponential IT Journey

Info-Tech resources:

Ongoing and tactical domain-level research and insights

The pace of technological change will continue to increase exponentially in the insurance industry

IT must solve the problem of rapidly and exponentially increasing expectations.

Organizations are adopting exponential technologies at an accelerated rate due to the rapidly changing landscape. Traditional linear IT is no longer viable to sustain IT’s place as the leading technology provider for their organization.

Failure to launch will leave you far behind. The chasm between the organization’s desire to harness technology and IT’s ability to deliver it will continue to widen.

The challenges with traditional linear IT:

- Slow to adapt to more modern service delivery models

- Processes and decision-making that can’t accelerate to meet demand

- Transactional arms-length relationships with organization units and vendors

- Insufficient funding and focus on technology innovation

- Locked into a siloed and hierarchical operating model

The Case for Exponential IT

IT needs to fundamentally transform the way it is operating in the following ways:

- Build an Adaptive Delivery Model: Enable flexible and efficient delivery of products and services.

- Optimize & Autonomize Operations: Maximize efficiency while mitigating risks through intelligent automation and data-driven decision-making.

- Broker Strategic Relationships: Strengthen and build both external and internal relationships to better align IT capabilities to organizational goals.

- Embrace Digital Innovation: Evaluate and adopt solutions that drive consumer value, enterprise growth, and innovation.

- Cultivate Workforce Flexibility: Dismantle traditional jobs and hierarchies, normalize new collaborative ways of working, and adopt a federated and hybrid IT operating model.

The insurance industry has significant challenges in adopting Exponential IT

Multiple Legacy/Siloed Systems

- Insurers are among the most challenged by legacy systems. The long-lived nature of insurance products has led insurers to have multiple generations of legacy systems supporting legacy products.

- A generational approach to modernization has entrenched silos. Product development and servicing approaches have led to new systems being developed to support new products, which deepens silos.

- Maintenance costs are consuming IT budgets. Legacy technology support costs are growing due to aging hardware and a shrinking workforce, taking away from budgets to enable exponential IT.

Captive Data and Processes

- Scarce resources have led to complex data challenges. Legacy data storage and resources were often used in unplanned ways to support changes and maximize existing resources.

- Policy features and design drove process complexity. Legacy technology frequently used highly integrated monolithic code bases. Change or modernization of this technology was feared.

- Insurers lacked the will and ability to address legacy data issues. Insurers have lacked the will, resources, and capabilities to address legacy systems, and the consequences of inaction were low.

Difficulty Acquiring and Retaining Required IT Talent

- Insurers feel they are losing the war for top IT talent. The insurance industry’s reputation as technology laggards is creating challenges when trying to recruit critical IT talent to the industry.

- Lack of technology talent will continue to hold back advanced technology adoption. The lack of top talent will continue to impede the insurance industry’s adoption of advanced technologies.

- The talent required to implement exponential IT will be intensely competitive. The human talent required to implement technologies such as quantum computing, post-quantum encryption, autonomization, etc., is scarce, and competition for the right talent will be extreme.

70% to 80%

of incumbent insurers’ budgets are spent on supporting legacy systems.

Source: InsurTech Magazine

18%

of insurers are able to optimize data use for competitive advantage.

Source: “Today Only 18% of Insurers…” Capgemini, 2022

50%

of insurance company employees will retire in the next 15 years.

Source: SMA Technologies

Navigate industry disruptions by adopting Exponential IT in the insurance industry

Market Disruptions and Obstacles

-

Customers are demanding a better customer experience (CX)

- AI and customer data are powering customer insight. AI’s ability to seek patterns in large data is transforming customer insights.

- Autonomization and computing power accelerate speed. Near real-time customized CX is becoming a reality and expectation for insurance customers.

-

Competition from existing insurers and new entrants continues to escalate

- Technology-powered innovation is spreading across the value chain. Marketing, distribution, support, risk, fraud detection, etc., are all being revolutionized.

- Advanced technologies are powering new products/services. Traditional insurers using old technology are struggling with product innovation.

-

Traditional business models are becoming outdated

- Demographic changes are driving changing preferences. Younger customers are not as informed about insurance and value different things.

- Technology is driving changes. Mobile capabilities and social media are changing the way products/services are designed, sold, and serviced.

-

The process of risk assessment, allocation, and pricing are being rapidly reshaped

- Innovations in data sources are reshaping risk. Internet of Things (IoT) data, satellite data, and health data are among the new types of data being analyzed to better understand risk.

- Computing and AI innovation are enabling new understanding. Rapid increases in computing and data insight capabilities are driving personalized risk.

Info-Tech Insight

The insurance industry is undergoing significant levels of technology-powered transformation that is reshaping every aspect of the industry. Exponential IT capabilities are central to this transformation. Insurers no longer have the luxury of time; they must begin their Exponential IT journey immediately.

Business opportunities are developed from industry disruptions

Challenges

-

Multiple Legacy/Siloed Systems

-

Captive Data and Processes

-

Difficulty Acquiring and Retaining Required IT Talent

Market Disruptions and Obstacles

-

Customers are demanding a better customer experience (CX)

-

Competition from existing insurers and new entrants continues to escalate

-

Traditional business models are becoming outdated

-

The process of risk assessment, allocation, and pricing are being rapidly reshaped

Institutional Opportunities

-

Create Attractive New Products/Services

New technologies with very different capabilities and cost structures will create the opportunity for fast-moving insurers to capitalize on first-mover advantage. -

Reduce Overall Cost Structure

By using Exponential IT elements, insurers can modernize their systems and introduce advanced capabilities such as AI and autonomization that can transform cost structures. -

Improve Customer Experience

New technology capabilities with different cost structures will fuel the creation of innovative new products and services. -

Address/Reduce Technical Debt

Exponential IT will require substantial investments in new technology that will help reduce technical debt, which will also help reduce reliance on legacy technology talent.

If IT leaders cannot lead this upcoming transformation, then the organization will move forward without them

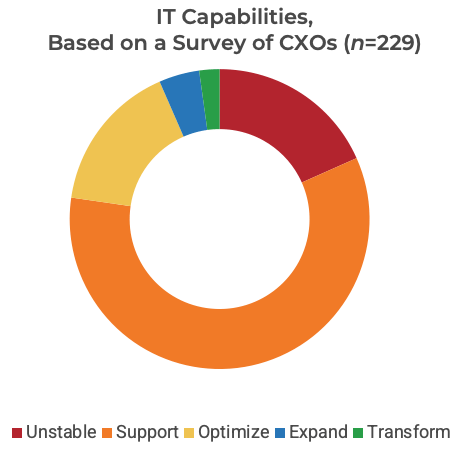

Only 2% of CXOs report that their IT department can transform the organization. Most IT departments (77%) still struggle to adequately support the organization.

33% of CXOs believe that their IT department must reach the highest level of Info-Tech’s IT maturity ladder to best serve the organization in the future. 42% of CIOs agree.

Info-Tech CXO-CIO diagnostic benchmark data, 2023, n=229 CXOs

Info-Tech CXO-CIO diagnostic benchmark data, 2023, n=229

Info-Tech Insight

As organizations strive to succeed in the next phase of technology-driven transformation, CIOs have an opportunity to demonstrate their organizational leadership. To do so, they will have to start delivering organizational capabilities instead of services while owning organizational targets.

Determine IT’s innovation maturity to assess Exponential IT readiness

Complete the CIO Business Vision Diagnostic to understand business needs and satisfaction with IT.

IT must score above 70 to be properly supported by the business and prepared for an Exponential IT shift.

Evaluate IT’s capability effectiveness and importance in executing Exponential IT

Complete the Management & Governance Diagnostic to assess core IT processes for improvement.

To properly execute Exponential IT, the organization must understand IT’s strengths and weaknesses for effectively managing and improving the department for innovation.

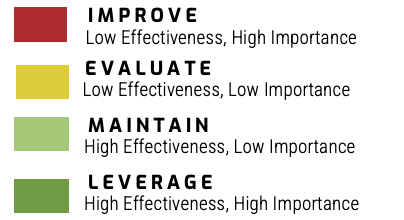

Collect the data the organization needs to start the process improvement journey and enable Exponential IT. The organization will get a customized report highlighting its most pressing IT process needs based on the following color coding.

Any processes that require improvement or evaluation should be prioritized for advancement before starting the Exponential IT journey. These core processes are required to effectively execute standard IT processes before innovating to Exponential IT processes.

Leverage Info-Tech’s Exponential IT Diagnostic to gauge readiness

Complete the Exponential IT Diagnostic to determine organizational and IT readiness for exponential technologies.

Info-Tech’s Exponential IT Readiness Diagnostic is designed to assess the readiness of your organization to embrace and extract value from exponential technologies. It measures executive stakeholder perceptions of organizational readiness for transformation and IT leader perceptions of IT readiness for transformation.

This readiness assessment is a crucial initial step in the Exponential IT journey to help you understand the needs, opportunities, and priorities of stakeholders across the organization.

Organizational readiness

Organizational readiness refers to perceived readiness to adopt exponential technologies and willingness to change into a more adaptable, forward-looking organization.

Without strong organizational readiness for transformation, IT will need to take extra steps to drive technology adoption, break down silos, and gain support for its own transformation efforts.

IT readiness

IT readiness includes current maturity across all IT domains, willingness and support for transformation, and foundational elements required for Exponential IT.

Without a high IT readiness for Exponential IT, the transformation roadmap may need to include additional foundational change efforts in its first year.

Key Exponential IT roadmap concepts