Your current data strategy is struggling because:

- Your strategy is based on traditional banking operations. The emergence of AI is changing how banking operates. Your strategy does not incorporate new AI-based business capabilities and the data required to support and enable them.

- It has primarily focused on existing static data/data at rest. Your strategy has not evolved to include real-time and unstructured data being generated.

- It has typically been focused on “traditional” structured data and doesn’t include unstructured data from conversations, digital agents, etc.

Our Advice

Critical Insight

Banks are struggling with AI-based data strategy because:

- They are historically focused on enabling only traditional banking processes and capabilities.

- There is a lack of acknowledgement of the impact that AI is having on traditional banking capabilities.

- There is a failure to recognize the dramatic impact AI has on data requirements and capabilities.

- Traditional approaches place a heavy focus on the existing relatively static structured data. AI increasingly uses unstructured data in real-time and the new requirements present unique challenges.

Impact and Result

Your new AI-based data strategy should:

- Consider the impact that AI is having across many elements of your business strategy and business capabilities.

- Reflect the changing nature of data consumed by AI to drive business value with a focus on unstructured data sources.

- Capture new data requirements that AI-powered business capabilities require.

- Seek to transform your data to be real time and easily accessible with the goal of enabling AI-powered internal and external capabilities.

Modernize Your Data Strategy to Enable AI/ML in Banking

Your bank is rushing to adopt AI/ML; modernizing your data strategy is critical for success.

Analyst Perspective

Your bank’s data strategy should be including the impact and needs of AI.

Now, more than ever, banks need to assure that their data strategy is effective in meeting the needs of the business. The data that flows from your strategy is powering massive changes in how your bank operates. The emergence of AI has focused even more attention on your data strategy.

The combination of data (that flows from your data strategy) and AI is reshaping critical areas within your bank, including customer insight and experience, risk, regulatory compliance, and intelligent automation of internal processes.

The initial wave of AI implementation brought with it attention to the data that already existed within your bank. Banks faced unique challenges with their data because of the evolution of their infrastructure and applications. Legacy systems, business silos, and closed applications combined with strict and growing regulatory and privacy requirements created very challenging conditions for the access and aggregation of data inside banks.

AI has been widely active in banking for several years now. Many banks are still trying to resolve the challenges that have already been identified. However, the influence of AI in banking is shifting from the consumption of existing data to the capture and ingestion of near real-time data. Most data strategies have failed to identify the current and future need for real-time data to power AI-based applications that continue to transform the banking industry.

David Tomljenovic MBA LL.M CIM

Principal Research Director

Financial Service Industry Lead

Info-Tech Research Group

Executive Summary

Your Challenge

Your existing data strategy is outdated and doesn’t address the unique challenges associated with your bank’s legacy infrastructure and systems that must now support AI and real-time data capture/ingestion.

Your current data strategy is struggling because:

- Your strategy is based on traditional banking operations. The emergence of AI is changing how banking operates. Your strategy does not incorporate new AI-based business capabilities and the data required to support and enable them.

- It has primarily focused on existing static data/data at rest. Your strategy has not evolved to include real-time and unstructured data being generated.

- It has typically been focused on “traditional” structured data and doesn’t include unstructured data from conversations/digital agents/etc.

Common Obstacles

A modern AI-centric data strategy requires your bank to reconsider the business, its processes, and its capabilities. Reimagining your bank’s capabilities also requires you to reconsider your data.

Banks are struggling with AI-based data strategy because:

- They are historically focused on enabling only traditional banking processes and capabilities.

- There is a lack of acknowledgement of the impact that AI is having on traditional banking capabilities.

- There is a failure to recognize the dramatic impact AI has on data requirements and capabilities.

- Traditional approaches place a heavy focus on existing structured data that is relatively static. AI increasingly uses unstructured data in real time; both new requirements present unique challenges.

Info-Tech’s Approach

AI is transforming banking products, services, and capabilities. It is essential that you update your data strategy to align with the new AI-powered approach to banking.

Your new AI-based data strategy should:

- Consider the impact that AI is having across many elements of your business strategy and business capabilities.

- Reflect the changing nature of data consumed by AI to drive business value with a focus on unstructured data sources.

- Capture new data requirements that AI-powered business capabilities require.

- Seek to transform your data to be real time and easily accessible with the goal of enabling AI-powered internal and external capabilities.

Info-Tech Insight

Banking, like most industries, is being transformed by AI. The impact of AI has deep implications for your bank’s products, services, and capabilities that must be considered during the creation of your data strategy and data requirements, yet many data strategies do not specifically focus on the effects of AI.

Your challenge

You are preparing to complete your bank’s data strategy and realize that the impact of AI hasn’t been fully considered.

- Your board, CEO, and senior leadership are looking for AI adoption. There is significant pressure from the senior levels of your bank to accelerate the adoption of AI. They don’t fully appreciate the importance of data to AI enablement. You need an AI-ready data strategy to meet your leadership’s AI expectations.

- Data strategy drives business goals but AI is reshaping business capabilities. Traditional data strategy supports traditional business goals by enabling traditional capabilities. Business goals are being completely reconsidered because of the impact of AI. AI is reshaping how banks operate and redefine what is possible. Your data strategy must now consider the potential of AI, which has a cascading effect on most of the steps that follow in your data strategy.

- Your infrastructure, systems, and applications are not well suited for AI. As AI spreads through your bank’s systems and capabilities, the need for real-time accessibility to a wide range of high-quality data from disparate sources intensifies. These demands further highlight many of the challenges associated with legacy systems and applications that are often trapped in deeply siloed business lines that were not designed to support the needs of AI.

Common obstacles

You don’t have a methodology to assess the impact of AI on business capabilities and the associated data requirements.

- Your bank is just beginning to deploy AI. AI is new to your bank, and you haven’t even completed your first use case implementation yet. As a result, you only have very limited experience with AI and must rely on others’ experience with assessing its impact on your data strategy.

- You haven’t had to consider the impact of AI on banking before. Your bank is very experienced with traditional data strategy, but you must now consider AI, and you haven’t done that before. The impact of AI has a cascading effect, and you don’t have a structured way to consider these changes.

- You had not considered the relationship of AI, business capabilities, and data requirements before. The adoption of AI puts into motion a series of changes that iterate on one another. A change during the early steps of your data strategy formation have consequences across most of the following steps. There are not guides that incorporate the impact of AI to help you through your updated data strategy process.

Info-Tech’s approach

Using a structured approach that updates traditional data strategy to include AI will accelerate your bank’s data success.

- Assess the impact of AI on business capabilities and the steps of your data strategy. Traditional data strategy for banks needs to be updated to assess and respond to the impact that AI is having on banking. Traditional data strategy is poorly suited for AI because the approach was developed well before AI emerged.

- Translate AI’s impact on business capabilities to map new data requirements. Data strategy is about enabling business capabilities in service of achieving business goals. The impact of AI on banking has been high and will continue to extend its reach. AI has very specific data requirements. Linking AI deployed to achieve business goals back to specific data requirements is a step that must be included in your banks data strategy.

- Explore new approaches to data designed to overcome the challenges of legacy systems. New AI-based data requirements will further highlight the limitations and challenges associated with legacy systems. Your bank must highlight these limitations and formulate a plan to address them.

Using your data to enable AI/ML is critical

Banks recognize the importance of AI/ML but data related challenges are presenting obstacles.

- Executives have high ambitions for AI to improve efficiency/productivity. 72% of executives reported that they see AI increase efficiency and productivity.

- Leaders believe AI will improve competitiveness. Business leaders believe that AI will help them improve their competitiveness (55%).

- Data quality is a challenge for adopting AI. 53% of survey respondents identified data quality and timelines as a challenge to their adoption of AI. Banks continue to struggle with data quality in the form of outdated or inaccurate data.

- Data silos continue to be a challenge for AI implementation. 48% of survey respondents identified data silos as an impediment to their AI capabilities. This is especially true in banks that are traditionally organized around business lines and/or geography.

- Data governance, security, and privacy also present challenges. 58% of respondents identified these data related challenges as a hinderance to their adoption of AI.

Only 8% of companies feel data is “very ready” for AI

IIF/EY survey illustrates the wide adoption of AI in banks

Banks expected to use AI to reduce expenses by 22%

AI will help banks save $1 trillion by 2030

(Sources: Snowflake, n.d.; Coforge, n.d.)

Modernize Your Data Strategy to Enable AI/ML in Banking

Your bank is rushing to adopt AI; modernizing your data strategy is critical for success.

Your Challenge

AI is reshaping data strategy.

AI is impacting business capabilities. Traditional banking product/service delivery is being transformed by AI; you must incorporate it into your data strategy process.

AI is redefining data requirements. The AI capabilities that are transforming banking capabilities require data. The scope and nature of the data is growing.

Legacy systems continue to impede AI adoption. AI requires access to data to function effectively. Legacy systems continue to impede AI implementation. Your data strategy must overcome legacy systems.

Common Obstacles

Lack of AI integration methodology.

AI has broad-reaching implications across most of traditional data strategy. Assessing its impact on the process can be challenging without a structured approach.

Mapping AI capability impact back into data requirements is hard. Starting with business needs is a good way to define data requirements.

AI further highlights the challenges from legacy systems. Once you complete your data strategy, it needs to be operationalized. Legacy technology must be factored into achieving your goals.

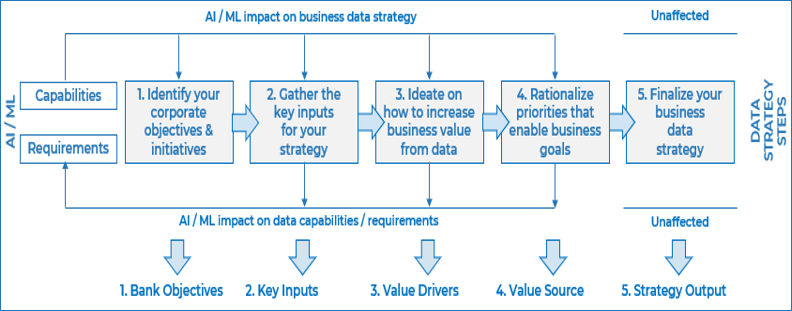

Info-Tech’s Approach

Traditional approaches to data strategy were created before the introduction of AI. The rapid adoption of AI requires a new approach to the traditional data strategy process. Your data strategy is intended to achieve business goals. Your new strategy must now consider AI’s impact on goals and the associated changes required to your data to attain them.

Focus on:

- Assessing AI adoption in your bank to gauge the overall level of impact that AI is having now as well as in the future.

- Consider the four areas AI is impacting business strategy, beginning with corporate objectives, key inputs, business value, and goals.

- Assess the impact on data requirements based on the new business strategy adjusted for the impacts of AI.

Action Steps:

- Start by assessing the impact of AI on your bank’s goals.

AI is transforming what is possible inside banks. The most significant impact comes when assessing the impact of AI of corporate goals, objectives, and initiatives. - Capture the cascading impact of AI on the other steps of your strategy.

Your data strategy is about achieving your bank’s goals. Once you determine the impact of AI, you must cascade this change across the remainer of the strategy process. - Translate the changes to your data strategy into new data requirements.

New AI powered capabilities create new data requirements. As you move through your data strategy, you must capture the new data requirements. Overcoming legacy technology issues is likely to be a major obstacle to address while executing your data strategy.

An AI-centric data strategy expands on traditional data strategies

Data Strategy Step |

New AI-Centric Data Strategy Component |

Traditional Data Strategy Approach |

|

Explore and document the impact that AI capabilities can have on your bank’s objectives |

|

|

Capture AI/ML tools and capabilities that your bank is considering deploying |

|

|

Brainstorm on the use of AI/ML capabilities to increase the value of your bank’s data to the business |

|

|

Assess AI/ML initiative feasibility |

|

Before you proceed

Assemble a broad stakeholder group to capture everyone’s input.

- Seek to eliminate silos through stakeholder engagement. Siloing represents a considerable challenge in banking. Business lines often work almost entirely independent of one another. These functional silos are often reflected in the technology and business capabilities as well. Use your stakeholder input process to break down barriers that may exist throughout your bank.

- Include individuals who execute the processes and support your banks capabilities. It is important to also have diverse representation across the functional roles in your bank. This will assure that you capture a wide cross section of feedback on data requirements as well as input on the potential for AI deployment.

- Be sure to include representatives from non-business-facing departments as well. Including employees from areas of your bank that don’t directly support the business. Groups like HR, legal, and facilities will also have a unique view of the data that resides within their domains. Similarly, they will likely have ideas about how and where to potentially deploy AI.

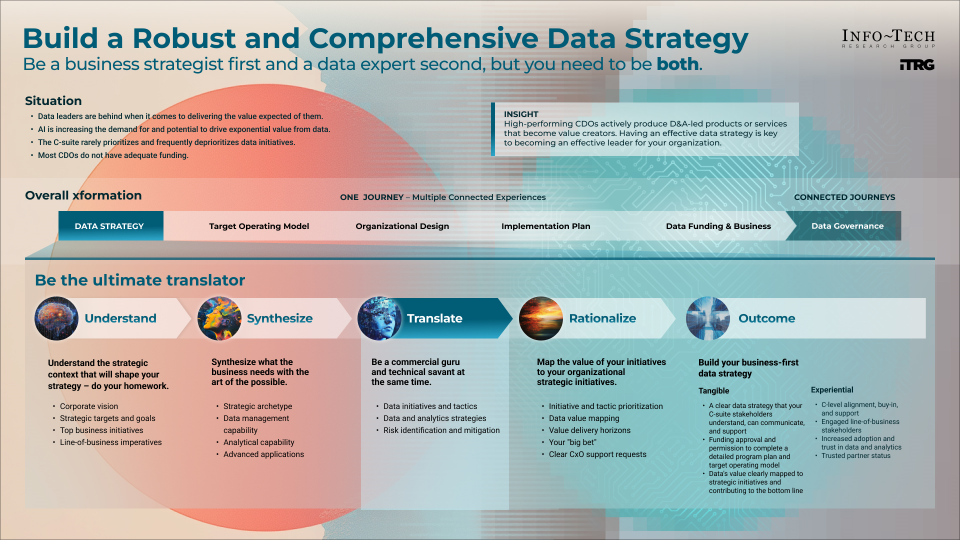

Info-Tech’s methodology for modernizing your application security services

1. Identify your bank’s objectives and initiatives |

2. Gather the key inputs for your strategy |

3. Ideate on how to increase business value from data |

4. Rationalize priorities that enable business goals |

5. Finalize your business data strategy |

|

Phase Steps |

|

|

|

|

|

Phase Outcomes |

|

|

|

|

|

Insight summary

Traditional data strategy should be reconsidered to include AI/ML impact.

Traditional strategy was developed in an era before the advent of AI/ML and didn’t consider the new capabilities, products, and services that they could enable. The goal of your data strategy is ultimately the attainment of business goals. The goals themselves have changed due to AI/ML and so must the data strategy.

AI/ML are redefining what is possible in the banking industry.

AI powered BOTs, real-time oversight of critical operations, near real-time customization of products and services are just a few of the ways that AI/ML are transforming the delivery of product and services in banking. Missions, values, goals, and capabilities must be reimagined through the lens of AI/ML capabilities as part of your new data strategy approach.

AI/ML require access to vast amounts of traditional and non-traditional data.

As your bank reimagines itself and its AI/ML-based capabilities, you must then empower your new capabilities with the data that is required to fuel them. Not only must your data be easily accessible, it must also be high quality/accurate. Increasingly, AI/ML requires data (existing and newly generated) to be immediately accessible, which is also new.

Your data strategy must now include nontraditional data sources.

AI itself is generating new types and sources of data, much of which is nontraditional and can be unstructured. AI powered BOTs, and transactional data all provide valuable sources of potential insight into customers and operations. These new data sources must become part of your data strategy and data requirements to power your AI/ML-based bank.

Your bank must harness all its data and assure it is accessible and portable.

Data strategy in the era of AI/ML is more essential than ever. AI/ML are reshaping banking, which has a cascading impact on the data requirements. In the new AI/ML era, data is evolving and expanding. Additionally, the need for speed and accessibility to data is new. You must step back and fundamentally reconsider your data strategy process to accommodate these new challenges and opportunities.

Blueprint deliverables

Key deliverable

Data Strategy for Banking C-Suite Presentation Template

A highly visual and compelling presentation template that enables easy customization and executive-facing content.

This report is accompanied by a sample Modernize Your Data Strategy to Enable AI in Banking Strategy C-Suite Presentation.

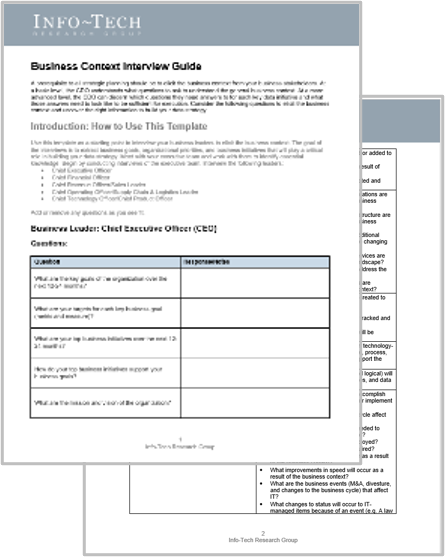

Business Context Interview for Banking Guide

Understand the strategic objectives of your bank so that you can align the right data initiatives.

Data Initiatives & Strategy Ideation for Banking Primer

Understand the art of the possible as you ideate through your data initiatives.

Data Strategy Stakeholder Interview Guide and Findings

Understand the line-of-business imperatives for data and analytics applications in your organization.

Data Value Mapping for Banking Tool

Establish and rationalize your data initiatives and tactics to support your bank’s goals.

Case Study

INDUSTRY: Financial Services | SOURCE: Accuracy Case Study

Harness bank data to solve complex fraud challenges through ML/AI.

Challenge

Danske Bank, Denmark’s largest bank with five million customers, was struggling with inaccurate and a labor-intensive fraud detection within their bank.

It used a traditional and highly manually intensive fraud detection capability that produced low efficiency results.

Their old system only captured 40% of the fraudulent activity within the bank. Their legacy capability also produced up to 1,200 false positives per day.

The system generated an excessive amount of manual effort while providing low levels of fraud detection.

Solution

The bank implemented a GPU-based fraud detection system that utilized a broad range of data to improve the accuracy of the detection system through the use of ML and AI.

As the bank continued to develop their fraud detection capabilities, their deep learning and machine learning supported the implementation of broader based AI fraud capabilities.

The system developed varying AI models through a process of continuous improvement and refinement of the ML/AI capabilities. The new system achieved real-time fraud monitoring and real-time self learning as data flowed through the bank and back into models.

Results

By freeing the bank’s data to circulate continuous operations into machine learning models which created new methods powered by AI, the bank was able to dramatically improve their fraud capabilities.

Danske bank was able to better identify actual fraud as well as reduce the number of false positives. These improvement resulted in dramatic reductions in the amount of human effort required and levels of fraud.

Danske bank was able to achieve a 60% reduction in false positives and a 50% increase in true positives. (Source: Accuracy, 2023.)

Measure the benefits of data strategy for AI/ML

Enablement of AI/ML will become a critical requirement for continued success.

- Your data strategy should enable your AI/ML capabilities and drive growth. Banking continues to become more competitive. Traditional products and services will not be enough to create meaningful differentiation. AI/ML can enable innovative new products/services as well as deep personalization. This will enable your bank to attract new customers and to grow more quickly.

- AI/ML will enable intelligent automation that should power scale and cost reductions, resulting in increased profitability. AI/ML will allow internal and external processes to use intelligent automation/Agentic AI, to replace low value human effort. This will allow the business to scale within incremental costs which, over time, will reduce costs and drive profitability.

- Banks must use AI/ML to defend against external threats also using AI/ML. The threat environment in banking continues to escalate. AI/ML is being used in a growing number of ways by bad actors. In many cases, the only way to combat AI/ML-based threats is through the deployment of AI/ML mitigation techniques.

Measure the value of this report

How can you measure the value of following Info-Tech’s approach?

Many traditional data strategy approaches are becoming outdated because of the growth in adoption of AI/ML. This is particularly true in banking where AI/ML is having a profound impact on business capabilities and changing the way banking operates.

Modernizing your data strategy for AI/ML has many benefits

Focus Area |

Potential Impact |

| Identify new AI/ML capabilities | Your modernized AI/ML data strategy should include the vital function of identifying new AI/ML-based capabilities to use in your bank. Perhaps they aren’t deployed immediately but it will get your bank thinking about the larger issues. |

| Document AI/ML tools | The process of identifying AI/ML capabilities and then linking them to potential AI/ML tools will advance your banks thinking in these critical areas. Documenting AI/ML tools will provide a reference point as you move forward in these areas. |

| Capture where AI/ML will drive the most impact | Your updated data strategy will help you to identify the areas of your bank that require the most attention and offer the most potential for positive benefits through the adoption of AI/ML. |

| Plan AI/ML initiatives within your bank | The systematic ideation, documentation, and application of AI/ML within your bank can become the foundation for your implementation plan. This can help coordinate your banks AI/ML strategy/roadmap. |

| Document the new data required to support you AI/ML | Planning for the adoption of AI/ML in your bank must be linked back to data requirements. Regardless of your intentions/desires to use, your bank must do the hard work of matching AI/ML uses to the data that supports these capabilities. |

AI/ML learning is transforming banking. The potential use cases grow daily. Without access to extensive high-quality data in near real time, your AI/ML capabilities cannot be realized.

Acknowledging the deep connection between new capabilities and your data is perhaps the greatest insight you can gain from your updated data strategy process.

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit |

Guided Implementation |

Workshop |

Executive & Technical Counseling |

Consulting |

| “Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful.” | “Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track.” | “We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place.” | “Our team and processes are maturing; however, to expedite the journey we'll need a seasoned practitioner to coach and validate approaches, deliverables, and opportunities.” | “Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project.” |

Diagnostics and consistent frameworks are used throughout all five options. |

||||

Guided Implementation

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your bank.

A typical GI is 4 to 8 calls over the course of 4 to 6 months.

Put your lifecycle-based API security modernization plan into action.

Phase 1 |

Phase 2 |

Phase 3 |

Phase 4 |

| Call #1: Identify your bank’s vision and goals and their impact of your AI-centric data strategy.

Call #2: Explore and document the impact that AI capabilities can have on your bank’s objectives and capabilities. |

Call #3: Evaluate line-of-business capabilities and data requirements.

Discuss AI/ML capabilities impact on your bank. Call #4: Identify critical risks to your data strategy as well as blockers to AI/ML adoption. |

Call #5: Evaluate line-of-business data gain and pain-relieving initiatives. Give specific attention to AI/ML.

Call #6: Capture gain and pain-relieving initiatives. |

Call #7: Consolidate your data initiatives and establish your top data priorities.

Call #8: Finalize your data strategy/initiatives and assign individuals to execute project. |

Leverage skilled facilitation

Info-Tech Research Group provides tabletop facilitation through its workshop product.

To enhance the effectiveness of external API Gateway and API process maturity implementation, consider involving a skilled facilitator with sufficient training and experience in conducting tabletop exercises.

Their expertise can help:

- Guide participants through the scenarios.

- Create dynamic discussions that respond to participant feedback.

- Ensure appropriate participants stay active.

- Provide insights on leading industry practices and potential improvements to your external API gateway and API process maturity implementation during and after the exercises.