The manufacturing industry faces a volatile demand landscape punctuated by new consumer behaviors, stalled global supply chains, prolonged product shortages, and a dramatic shift to online retail. Demand planning and forecasting have never been an exact science, but today’s post-pandemic environment requires a modern approach that is definitely more science than art.

CIOs have a strategic opportunity to drive optimized demand planning with a fit-for-purpose demand planning system and a holistic view of planning philosophy and performance management.

Improve demand planning maturity for top-line and bottom-line results

To advance the maturity of the manufacturing demand planning ecosystem, organizations should address gaps across performance management, analytics, and data and systems:

- Graduate to integrated business planning (IBP), demand excellence, and collaborative planning, forecasting, and replenishment (CPFR).

- Apply quantitative methods powered by machine learning.

- Deploy the right mix of key performance indicators (KPIs) to monitor planning performance.

- Deploy built-for-purpose demand planning software.

- Integrate software with critical data sources and other supply chain systems.

This research maps the demand planning journey to help manufacturing CIOs optimize their organization’s efforts – with the right framework and the right technology.

Member Testimonials

After each Info-Tech experience, we ask our members to quantify the real-time savings, monetary impact, and project improvements our research helped them achieve. See our top member experiences for this blueprint and what our clients have to say.

9.0/10

Overall Impact

$67,500

Average $ Saved

14

Average Days Saved

Client

Experience

Impact

$ Saved

Days Saved

Ingham’s Enterprises Pty Ltd

Guided Implementation

9/10

$67,500

14

Very relevant research that will assist with framing our thinking in regards Demand Planning / Supply Planning tools and processes.

TEKsystems

Guided Implementation

9/10

N/A

N/A

Valuable in assisting me recognize cross industry translation of demand management.

How CIOs Can Get Manufacturing Demand Planning Right

Straight line to results: Optimize demand planning to effectively meet rapidly evolving customer demand.

Analyst Perspective

Even before COVID-19 hit, the manufacturing industry had been contending with demand volatility. However, the pandemic highlighted the impact that external factors had on consumer demand: global supply chains stalled, a drastic reduction in the number of SKUs supplied by businesses, prolonged shortages of popular products, and a dramatic shift to online retail.

Conducting accurate demand forecasting and planning has never been an easy task. Effective demand planning has far-reaching consequences to your top-line and bottom-line by ensuring enough goods are produced and sold through the right channels, production planning is conducted in an optimum manner, the right level of inventory is maintained, and the total cost of supply chain ownership is low. There are several challenges businesses must overcome to get to the ideal operating state with demand planning. Legacy forecasting tools and Excel often cannot handle the amount of data required for an accurate plan, nor can they capture all available opportunities.

At the other end of the spectrum, traditional ERP systems do not provide planners with the flexibility they need to simulate options, test forecasting models, and adjudicate the accuracy of their demand planning logic. The answer to optimization challenges is a two-pronged approach; use a built-for-purpose demand planning system, and take a holistic view of your planning philosophy and performance management framework. In this research, we introduce the modern supply chain planning landscape, take a deep dive into demand management and its challenges, give you an overview of the ideal technology end state for demand planning, and introduce fit-for-purpose software. We then discuss some case studies spanning durable, non-durable, food and beverage, and chemical manufacturing industries to give you an idea of how other companies have approached the optimization of demand planning.

Shreyas Shukla

Principal Research Director, Manufacturing Industry

Info-Tech Research Group

Executive Summary

The most critical aspect of optimized demand planning is choosing a fit-for-purpose demand planning system which will provide a business with the capability and flexibility it needs to perform accurate demand planning.

Your ChallengeDealing with demand volatility has been an ongoing challenge made more severe by the Covid-19 pandemic. While most businesses have realized the value that accurate demand planning brings, they continue to struggle with transitioning demand planning from being administrative to strategic.

|

Common ObstaclesBusinesses will have to take a holistic view of their demand planning ecosystem to reach an ideal, optimized end state. Several obstacles pose a threat to improving demand planning maturity:

|

Info-Tech's ApproachBusinesses have realized that predicting demand accurately is essential. While demand planning is not an exact science, choosing the right approach and technology will improve the demand planning process and accuracy. Info-Tech will provide:

|

How CIOs Can Get Demand Planning Right

Straight line to results: Optimize demand planning to effectively meet rapidly evolving customer demand.

EXECUTIVE BRIEF

COVID-19 made accurate demand planning extremely challenging

COVID-19 injected new complexities into the formal forecasting and planning processes. Businesses found that traditional forecasting and planning methods couldn’t keep up with constant market volatility. Demand cratered, then recovered, and reached unprecedented levels before entering the still-evolving soft downturn of early 2023.

New demand patterns emerged in 2020, forcing businesses to rethink their demand strategy.

Source: McKinsey, 2020

Businesses had to respond rapidly to a new kind of consumer

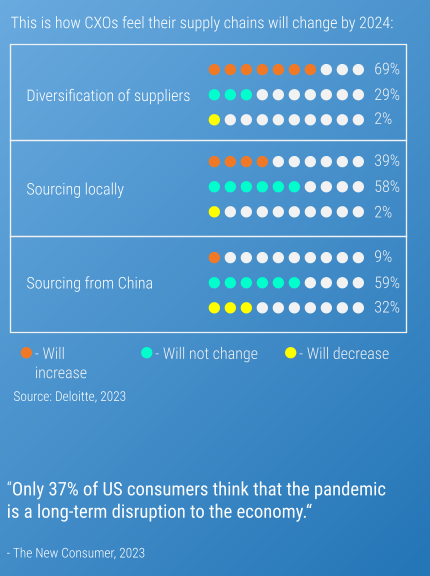

Disruptions during the pandemic, ongoing trade wars, geopolitical events, and rising inflation have resulted in a new global environment. Businesses have had to make a valiant effort to continue their manufacturing operations to stock shelves with product, while dealing with overtaxed and elongated supply chains.

Source: The New Consumer, 2023

The start of 2023 had some challenges in confidence

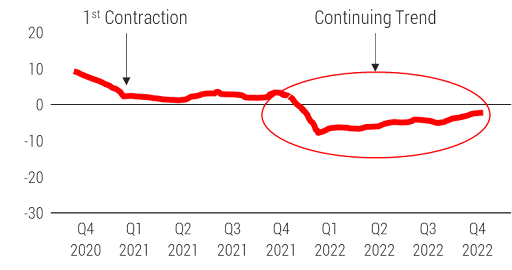

Businesses seem to be struggling with a large stockpile of inventory Companies may be forced to pause, delay or cancel orders, impacting supplier cash flow in favor of their own cashflow; this will negatively impact suppliers. There are indicators of a looming downturn led by a collapse in demand across the transport and logistics sector worldwide. While the economic environment has changed significantly since the pandemic began, 2023 is beginning to feel like a relapse of early 2020.

Quarter on quarter % growth of global transaction volumes

Source: Tradeshift, 2023

Global order volumes have been in freefall since Q4 2021. While trends show order volumes in contraction territory, there has been marginal improvement all through 2022.Year-over-year change in US consumer spending

Source: Earnest Analytics. 4-week trailing average, 2022

Transaction volumes in the US seem to doing worse quarter-on-quarter. The US Dept. of Commerce suggests that consumer spending is trending downward and US supply chains are sitting on high stockpiles of inventory.US Consumer Sentiment Index

Source: University of Michigan Surveys of Consumers, 2022

Consumer sentiment was at an all-time low in June 2022, but started showing marginal signs of improvement.Change in US Consumer Price Index

Source: US Bureau of Labor Statistics, 2022

Inflation in the US continues to remain at 40-year highs, despite some minor relief toward the end of 2022.Transportation and manufacturing sectors are seeing a slowdown

Logistics managers are concerned for the future. The November 2022 Logistics Manager’s Index is at 53.6, the second lowest reading in its history. The lowest reading of 51.3 was from April 2020. This is due to low inventory levels, lower than expected manufacturing activity, expensive warehousing and a post-holiday spending lull with an expected downturn in 2023.

Transportation and logistics sector is firmly in slowdown territory. Overall warehouse capacity and transportation prices contracted considerably in 2022.

Manufacturing saw a slight improvement in Q4 2022 due to consistent easing of supply bottlenecks. The manufacturing sector, however, continues to remain in contraction territory due to waning demand after the holiday season, and careful spending by consumers due to fears of a looming recession.

Retail has been performing near expectation for the majority of 2022. The holiday season has been lucrative with month-on-month sales up by over 7% from November to December.

Technology Spending outperformed all other sectors in Q4, 2022 despite the hammering that tech stocks have received due to economic headwinds. Businesses continue to invest in digital transformation initiatives and worldwide IT spending is expected to grow by 5.1% in 2023.

Global quarter on quarter % growth of global transaction volumes by sector

“CEOs and boards tell me they are cautious, particularly in the near term. They're rethinking business opportunities and would like to see more stability before committing to longer-term plans. Many firms have started preparing for tougher times, focusing on factors within their control.”

- David Solomon, CEO, Goldman Sachs; quoted in Business Insider India, January 21, 2023.

Source: Tradeshift, 2023

Planning is the primary focus going forward.

Supply chain planning is the top priority for organizations in 2023 (Supply Chain Management Priorities and Challenges survey, APQC, 2023). Demand planning and forecasting is the top focus area within supply chain planning.

Continued disruptions and demand volatility mean that demand planning and forecasting will be a key competitive differentiator. From the start of the COVID-19 pandemic till now, most businesses feel that investing in better planning capabilities will ensure they meet and / or exceed their goals.

Source: APQC, 2023

Section 1

Introduction to demand planning and advanced planning concepts

Section 1

|

section 2

|

section 3

|

section 4

|

section 5

|

Optimize demand planning to effectively meet rapidly evolving customer demand