- Private Equity & Venture Capital leadership requires a unified and validated view of business capabilities that helps CIOs and leadership accelerate the strategy design process and that aligns initiatives, investments, and strategy.

- The business and IT often focus on a project, ignoring the holistic impact and value of an overarching value stream and business capability view.

Our Advice

Critical Insight

Using an industry-specific business reference architecture is central and has many benefits to organizational priorities. It’s critical to understanding, modeling, and communicating the operating environment and the direction of the organization, but more significantly, to enabling measurable top-line organizational outcomes and the unlocking of direct value.

Impact and Result

- Demonstrate the value of IT’s role in supporting your organization’s capabilities while highlighting the importance of proper alignment between organizational and IT strategies.

- Apply reference architecture techniques such as strategy maps, value streams, and capability maps to design usable and accurate blueprints of your private equity & venture capital operations.

- Assess your initiatives and priorities to determine if you are investing in the right capabilities. Conduct capability assessments to identify opportunities and to prioritize projects

Private Equity and Venture Capital Industry Business Reference Architecture

Business capability maps, value streams, and strategy maps for the Private Equity and Venture Capital Industry

Analyst Perspective

In the age of disruption, IT must end misalignment and enable value realization.

An industry business reference architecture helps accelerate your strategy design process and enhances IT’s ability to align people, process, and technology with key business priorities.

Private Equity and Venture Capital firms are going through a period of rapid change. Most of the core processes and technology are changing, which is creating the need for new talent within these organizations. Part of the challenge with significant change is communicating the complexity to the business and the broader community of stakeholders. The reference architecture is a powerful communications and alignment tool you can use to engage and inform stakeholders.

| David Tomljenovic, MBA LL.M CIM |

Executive Summary

Your Challenge

| Common Obstacles

| Info-Tech’s Approach

|

Info-Tech Insight

Utilizing an industry-specific reference architecture is central, and has many benefits, to organizational priorities. It’s critical to understanding, modeling, and communicating the operating environment and the direction of the organization. More significantly, it is needed to enable measurable top-line organizational outcomes and the unlocking of direct value.

Reference Architecture Framework

Overarching InsightUsing an industry-specific reference architecture is central and has many benefits to organizational priorities. It's critical to understanding, modeling, and communicating the operating environment and the direction of the enterprise, and more significantly, to enabling measurable top-line business outcomes and the unlocking of direct value. Determine your organizational priority.Many organizational priorities are dependent on an understanding of how the organization creates value and the organization's capabilities and processes. Examine organizational opportunities through the lens of business, information/data, applications & technology.Your understanding of your organization's business capabilities, processes (rules & logic), information/data, and architecture will identify organizational opportunities to create value through reduced costs or increased revenues and services. Follow Info-Tech's methodology to enable organizational outcomes and unlock direct value.Your approach indicates the scope of your modernization initiatives. Build your organization's capability map by defining the organization's value stream and validating the industry reference architecture. USe business capabilities to define strategic focus by defining the organization's key capabilities and developing a prioritized strategy map. Assess key capabilities for planning priorities through a review of business processess, information, applications, and technology support of key capabilities. Sustain capability-based strategy planning through ongoing identification and roadmapping of capability gaps. |

|

Industry Overview: Private Equity and Venture Capital

The Private Equity and Venture Capital industry is experiencing a period of rapid change. Institutional investor preferences are shifting as a result of the rapid adoption of ESG principles. At the same time, there has been a tremendous increase in the amount of capital entering the industry and the number of investment opportunities has not increased proportionately, resulting in an escalating level of competition for assets.

Technology has increasingly been adopted to address some of the changes that the industry is experiencing. Growing use of CRM systems, automation, and workflow optimizations have been driving change. Private equity and venture capital firms with in-house employees are rapidly changing to reflect the new realities of the industry.

Business value realization

Business value defines the success criteria of an organization as manifested through organizational goals and outcomes, and it is interpreted from four perspectives:

| Business Value Matrix |

Value, goals, and outcomes cannot be achieved without business capabilities

Break down your business goals into strategic and achievable initiatives focused on specific value streams and business capabilities.

Rapidly intensifying competition: Editable business capability mapInstructions: Adjust the color of each business capability for your organization. PowerPoint’s Eyedropper tool is useful here. |  |

Private Equity and Venture Capital business capability map

Business capability map defined…

In business architecture, the primary view of an organization is known as a business capability map.

A business capability defines what a business does to enable value creation, rather than how. Business capabilities:

- Represent stable business functions.

- Are unique and independent of each other.

- Typically will have a defined business outcome.

A business capability map provides details that help the business architecture practitioner direct attention to a specific area of the business for further assessment.

Glossary of Key Concepts

A business reference architecture consists of a set of models to provide clarity and actionable insight and value. Typical techniques and terms used in developing these models are:

| Term/Concept | Definition |

| Industry Value Chain | A high-level analysis of how the industry creates value for the consumer as an overall end-to-end process. |

| Business Capability Map | The primary visual representation of the organization’s key capabilities. This model forms the basis of strategic planning discussions. |

| Industry Value Streams | The specific set of activities an industry player undertakes to create and capture value for and from the end consumer. |

| Strategic Objectives | A set of standard strategic objectives that most industry players will feature in their corporate plans. |

| Industry Strategy Map | A visualization of the alignment between the organization’s strategic direction and its key capabilities. |

| Capability Assessments | Based on people, process, information, and technology, a heat-mapping effort that analyzes the strength of each key capability. |

| Capability | An ability that an organization, person, or system possesses. Capabilities are typically expressed in general and high-level terms and typically require a combination of organization, people, processes, and technology to achieve. |

Tools and templates to compile and communicate your reference architecture work

|

Download the Private Equity And Venture Capital Industry Reference Architecture Template |

Info-Tech’s methodology for Reference Architecture

| 1. Build your organization’s capability map | 2. Use business capabilities to define strategic focus | 3. Assess key capabilities for planning priorities | 4. Adopt capability-based strategy planning | |

| Phase Steps | 1.1 Define the Organization’s Value Stream 1.2 Develop a Business Capability Map | 2.1 Define the Organization's Key Capabilities 2.2 Develop a Strategy Map | 3.1 Business Process Review 3.2 Information Assessment 3.3 Technology Opportunity Identification | 4.1 Consolidate and Prioritize Capability Gaps |

| Phase Outcomes |

|

|

|

|

Info-Tech offers various levels of support to best suit your needs

DIY Toolkit | Guided Implementation | Workshop | Consulting |

| "Our team has already made this critical project a priority, and we have the time and capability, but some guidance along the way would be helpful." | "Our team knows that we need to fix a process, but we need assistance to determine where to focus. Some check-ins along the way would help keep us on track." | "We need to hit the ground running and get this project kicked off immediately. Our team has the ability to take this over once we get a framework and strategy in place." | "Our team does not have the time or the knowledge to take this project on. We need assistance through the entirety of this project." |

Diagnostics and consistent frameworks used throughout all four options | |||

Guided Implementation

A Guided Implementation (GI) is a series of calls with an Info-Tech analyst to help implement our best practices in your organization.

A typical GI is between six to nine calls over the course of one to four months.

What does a typical GI on this topic look like?

Phase 1 | Phase 2 | Phase 3 | Phase 4 | |

| Call #1: Introduce Info-Tech’s industry reference architecture methodology. | Call #2: Define and create value streams. Call #3: Model Level 1 business capability maps. | Call #4: Map value streams to business capabilities. Call #5: Model Level 2 business capability maps. | Call #6: Create a strategy map. Call #7: Introduce Info-Tech's capability assessment framework. | Call #8: Review capability assessment map(s). Call #9: Discuss and review prioritization of key capability gaps and plan next steps. |

Private Equity and Venture Capital Industry Business Reference Architecture

Phase 1

Build your organization’s capability map

| Phase 1 1.1 Define the Organization’s Value Stream 1.2 Develop a Business Capability Map | Phase 2 2.1 Define the Organization’s Key Capabilities 2.2 Develop a Strategy Map | Phase 3 3.1 Business Process Review 3.2 Information Assessment 3.3 Technology Opportunity Identification | Phase 4 4.1 Consolidate and Prioritize Capability Gaps |

This phase will walk you through the following activities:

- Identify and assemble key stakeholders

- Determine how the organization creates value

- Define and validate value streams

- Determine which business capabilities support value streams

- Accelerate the process with an industry reference architecture

- Validate the business capability map

- Establish level 2 capability decomposition priorities

- Decompose level 2 capabilities

This phase involves the following participants:

- Enterprise/Business Architect

- Business analysts

- Business unit leads

- CIO

- Departmental Executive and senior managers

Step 1.1

Define the organization’s value stream

Activities

- 1.1.1 Identify and assemble key stakeholders

- 1.1.2 Determine how the organization creates value

- 1.1.3 Define and validate value streams

This step will walk you through the following activities:

- Identify and assemble key stakeholders

- Determine how the organization creates value

- Define and validate value streams

This step involves the following participants:

- Enterprise/Business Architect

- Business analysts

- Business unit leads

- CIO

- Departmental Executive and senior managers

Outcomes of this step

- Defined and validated value streams specific to your organization

| Step 1.1 | Step 1.2 |

1.1.1 Identify and assemble key Stakeholders

1-2 hoursInput: List of who is accountable for key business areas and decisions, Organizational chart, List of who has decision-making authority

Output: A list of the key stakeholders, Prioritized list of decision making support needs, Reference Architecture Template

Materials: Whiteboard/Flip Charts, Reference Architecture Template

Participants: Enterprise/Business Architect, Business analysts, Business unit leads, CIO, Departmental Executive and senior managers

Build an accurate depiction of the business.

- It is important to make sure the right stakeholders participate in this exercise. The exercise of identifying capabilities for an organization is very introspective and requires deep analysis.

- Consider:

- Who are the decision makers and key influencers?

- Who will impact the business capability work? Who has a vested interest in the success or failure of the outcome?

- Who has the skills and competencies necessary to help you be successful?

- Avoid:

- Don’t focus on the organizational structure and hierarchy. Often stakeholder groups don’t fit the traditional structure.

- Don’t ignore subject-matter experts on either the business or IT side. You will need to consider both.

Download the Reference Architecture Template

Define the organization’s value streams

- Value streams connect business goals to the organization’s value realization activities. They enable an organization to create and capture value in the market place by engaging in a set of interconnected activities. Those activities are dependent on the specific industry segment an organization operates within. Value streams can extend beyond the organization into the supporting ecosystem, whereas business processes are contained within and the organization has complete control over them.

- There are two types of value streams: Core value streams and Support value streams. Core value streams are mostly externally facing: they deliver value to either an external or internal customer and they tie to the customer perspective of the strategy map. Support value streams are internally facing and provide the foundational support for an organization to operate.

- An effective method for ensuring all value streams have been considered is to understand that there can be different end-value receivers. Info-Tech recommends identifying and organizing the value streams with customers and partners as end-value receivers.

Value stream descriptions for Private Equity and Venture Capital

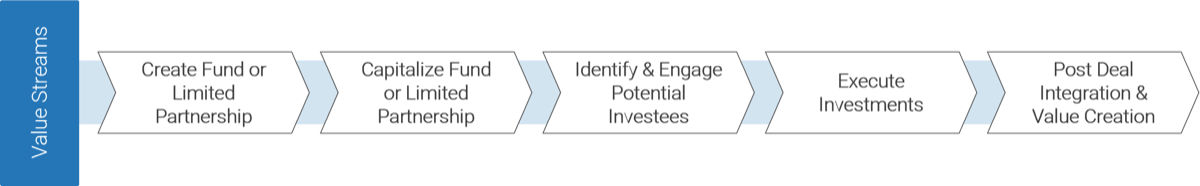

Value | Create Fund or Limited Partnership | Capitalize Fund or Limited Partnership | Identify & Engage Potential Investees | Execute Investments | Post-Deal Integration & Value Creation |

|

|

|

|

|

Determine how the organization creates value

| Begin the process by identifying and locating the business mission and vision statements.

| What is Business Context? “The business context encompasses an understanding of the factors impacting the business from various perspectives, including how decisions are made and what the business is ultimately trying to achieve. The business context is used by IT to identify key implications for the execution of its strategic initiatives.” (Source: Business Wire, 2018) |